Hertz 2014 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

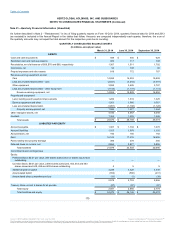

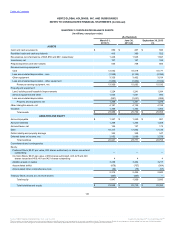

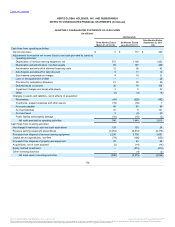

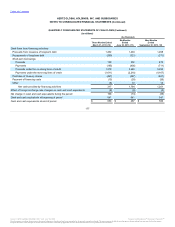

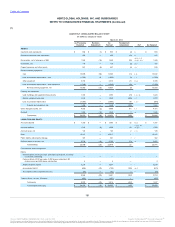

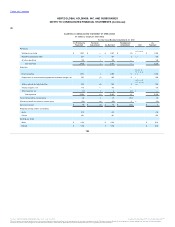

The following tables present the impact of the restatement adjustments for each quarterly period within fiscal 2013 presented in the tables on the

preceding pages. As further described in Note 2 - "Restatement," During the fourth quarter of 2013, the Company identified certain out of period

errors related to its previously issued financial statements, which included the condensed consolidated financial statements for the quarterly and

year to date periods ended March 31, June 30 and September 30, 2013 ("first", "second" and "third" quarter, respectively). While these errors did

not, individually or in the aggregate, result in a material misstatement of the Company's previously issued consolidated financial statements,

correcting these, and the errors for periods 2012 and prior, in the fourth quarter of 2013 would have been material to that quarter. Accordingly,

management revised its previously reported condensed consolidated financial statements in the Form 10-K/A for the year ended December 31,

2013 filed with the SEC on March 20, 2014, however, presentation of quarterly and year to date information for the periods above included in the

filing was limited to the statements of operations. Therefore, the column in the tables below labeled "As Previously Reported" reflect the financial

information for the first, second and third quarters of 2013 as presented in their respective filings on Form 10-Q as filed with the SEC on May 2,

August 2, and November 7, 2013, respectively.

The column in the tables below labeled "Revision Adjustment" reflect the revisions for the respective quarterly periods in 2013. The column in the

tables below labeled "As Revised" reflect the quarterly financial information that was revised in the 2013 Form 10-K/A.

The column in the tables below labeled "Restatement Adjustment" reflect the adjustments associated with the restatement of 2013 consolidated

financial statements as further described in Note 2 - "Restatement." The references identified in the tickmarks to the 2013 tables directly correlate

to the adjustments detailed below. Amounts are computed independently each quarter, therefore, the sum of the quarterly amounts may not equal

the total amount for the respective year due to rounding.

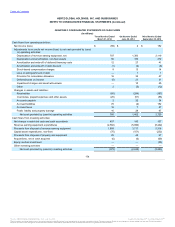

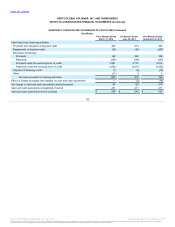

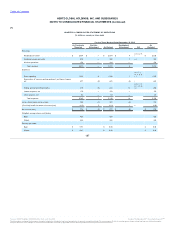

(a) Allowance for Doubtful Accounts and Credit Memos (U.S. Car Rental) - The historical methodology employed for doubtful customer accounts

and credit memo allowances for the U.S. Car Rental business inappropriately used inaccurate write-off rates for receivables, aggregated

receivables with significantly different credit risks for purposes of analysis and used assumptions in setting the reserve for credit memos that were

not supported. Inappropriate tone at the top, among other factors, may have contributed to this restatement matter.

(b) Allowance for Doubtful Accounts and Credit Memos (International Car Rental) - The historical methodology employed for doubtful customer

accounts and credit memo allowances for the international car rental business inappropriately used inaccurate write-off rates for receivables,

aggregated receivables with significantly different credit risks for purposes of analysis and did not include a reserve for credit memos.

Inappropriate tone at the top, among other factors, may have contributed to this restatement matter.

(c) Allowance for Doubtful Accounts and Credit Memos (Worldwide Equipment Rental) - The historical methodology employed for doubtful

customer accounts and credit memo allowances for the worldwide equipment rental business inappropriately used rates that differed from historical

norms, used unsupported assumptions, and contained formulaic errors. In addition, changes to the methodology in 2012 reduced the reserve

requirement and slowed the rate of recording account write-offs. Inappropriate tone at the top, among other factors, may have contributed to this

restatement matter.

(d) Subrogation (Damage) Receivables and the Related Allowance for Doubtful Accounts (U.S. Car Rental) - This restatement matter relates to

estimated recoveries from third parties responsible for damages to vehicles. The historical methodologies used to estimate the unbilled balances

and the allowance accounts inappropriately used assumptions that lacked support, including using write-offs rather than collection history as a key

assumption and changed methodologies without any supported basis, as well as contained formulaic errors. In addition, there were instances in

which the amount recorded for the allowance was significantly less than the amount calculated based on the methodology in place at the time. The

Company has revised the methodology used to calculate subrogation claims to utilize the ratio of claims collected compared to damage expense

incurred. Inappropriate tone at the top, among other factors, may have contributed to this restatement matter.

178

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.