Hertz 2014 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

million shares of its common stock, paying cash premiums of approximately $12 million and incurring a loss on extinguishment of debt of $28

million which was recorded in "Other (income) expense, net."

In January 2014, another conversion right on its Convertible Senior Notes was triggered and in May 2014, substantially all of the Convertible Senior

Notes were exchanged for 10 million shares of its common stock. The Convertible Senior Notes that were not previously converted matured in

June 2014 and there are no longer any Convertible Senior Notes outstanding.

In re Hertz Global Holdings, Inc. Securities Litigation

In November 2013, a purported shareholder class action, Pedro Ramirez, Jr. v. Hertz Global Holdings, Inc., et al., was commenced in the U.S.

District Court for the District of New Jersey naming Hertz Holdings and certain of its officers as defendants and alleging violations of the federal

securities laws. The complaint alleges that Hertz Holdings made material misrepresentations and/or omissions of material fact in its public

disclosures during the period from February 25, 2013 through November 4, 2013, in violation of Section 10(b) and 20(a) of the Securities Exchange

Act of 1934, as amended, and Rule 10b-5 promulgated thereunder. Plaintiffs seek an unspecified amount of monetary damages on behalf of the

purported class and an award of costs and expenses, including counsel fees and expert fees. In June 2014, Hertz Holdings responded to the

amended complaint by filing a motion to dismiss. In August 2014, the plaintiffs filed their opposition to the Company's motion to dismiss and also

filed a motion to strike certain exhibits which were included in the Company's motion to dismiss. After a hearing in October 2014, the court granted

the Company's motion to dismiss the complaint. The dismissal was without prejudice and plaintiff was granted leave to file a second amended

complaint within 30 days of the order. The motion to strike was dismissed as moot. In November 2014, plaintiffs filed an amended complaint which

shortened the putative class period such that it is not alleged to have commenced until May 18, 2013 and makes allegations that are substantively

similar to the allegations in the prior complaint. In early 2015, this case was assigned to a new federal judge in the District of New Jersey.

Plaintiffs filed their opposition to the Company's motion to dismiss in January 2015. In February 2015, Hertz Holdings filed its reply to Plaintiffs’

opposition. Hertz Holdings believes that it has valid and meritorious defenses and it intends to vigorously defend against these allegations, but

litigation is subject to many uncertainties and the outcome of this matter is not predictable with assurance. It is possible that this matter could be

decided unfavorably to Hertz Holdings, however, Hertz Holdings is currently unable to estimate the range of these possible losses, but they could

be material.

Governmental Investigations

In June 2014 the Company was advised by the staff of the New York Regional Office of the Securities and Exchange Commission (the “SEC”) that

it is investigating the events disclosed in certain of the Company’s filings with the SEC. In addition, in December 2014 a state securities regulator

requested information regarding the same events. The investigations generally involve the restatements described in this report and related

accounting for prior periods. The Company has and intends to continue to cooperate with both the SEC and state requests. Due to the stage at

which the proceedings are, Hertz is currently unable to predict the likely outcome of the proceedings or estimate the range of reasonably possible

losses, which may be material.

For a discussion of the commitments and contingencies of the indirect subsidiaries of Hertz Holdings, see Note 11, "Lease and Concession

Agreements," and Note 14, "Contingencies and Off-Balance Sheet Commitments," to the Notes to its consolidated financial statements included in

this Annual Report under the caption “Item 8—Financial Statements and Supplementary Data.”

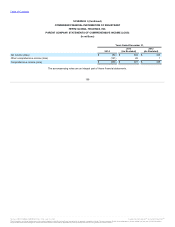

During 2013 and 2012, Hertz Holdings received approximately $482 million and $25 million, respectively, of return of capital and cash dividends

from its subsidiaries for the purchase of stock and payment of interest related to the Convertible Senior Notes. There was no return of capital or

dividends received during 2014.

202

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.