Hertz 2014 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

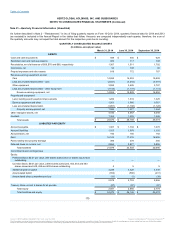

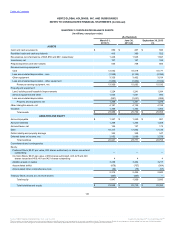

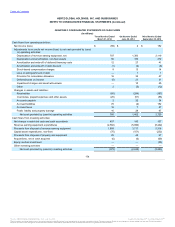

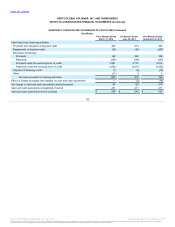

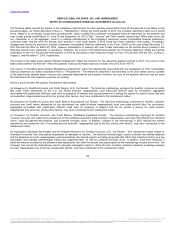

(e) Subrogation (Damage) Receivables and the Related Allowance for Doubtful Accounts (International Car Rental) - This restatement matter

relates to estimated recoveries from third parties responsible for damages to vehicles. The historical methodologies used to estimate the

allowance accounts inappropriately used assumptions that lacked support, including using write-offs rather than collection history as a key

assumption, as well as contained formulaic errors. In addition, there were instances in which the amount recorded for the allowance was

significantly less than the amount calculated based on the methodology in place at the time.

(f) Accrued Salvaged Vehicles (U.S. Car Rental) - This restatement matter relates to the reserve for estimated vehicle damages incurred in the

U.S. car rental business but not reported as of period ends. The methodology used to estimate the reserve was changed without appropriate

supporting documentation and the most significant, required element of the reserve was eliminated. As part of the restatement process, the

Company has reinstated the previous methodology. Inappropriate tone at the top, among other factors, may have contributed to this restatement

matter.

(g) Credit Card Chargebacks (U.S. and International Car Rental) - The restatement matter relates to reserves established to accrue for future credit

card chargebacks pertaining to completed revenue transactions with customers and for chargebacks received from credit card providers. The

reserves were understated in 2011, 2012 and 2013 for a variety of reasons. These reasons included (1) the Company inappropriately changed the

methodology for computing reserves established to accrue for future chargebacks in 2013 and (2) the Company erroneously excluded chargebacks

received from credit card providers from the balances used to calculate the allowance for doubtful accounts. Inappropriate tone at the top, among

other factors, may have contributed to this restatement matter.

(h) Rental Equipment Refurbishment (Worldwide Equipment Rental) - This restatement matter relates to refurbishment designed to extend the

useful life of rental equipment used in the worldwide equipment rental business. At the time of refurbishment, the Company improperly reduced the

cost basis of rental equipment that was subject to useful life extension. The reduction was effected by reversing accumulated depreciation on

refurbished equipment as an offset to original cost. Inappropriate tone at the top, among other factors, may have contributed to this restatement

matter.

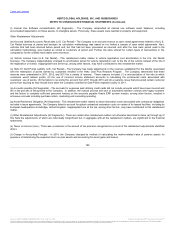

(i) Fixed Assets and Construction in Progress and Capitalized Software (U.S. Car Rental, Worldwide Equipment Rental and Corporate) - This

restatement matter relates to accounting for non-fleet fixed asset (e.g., leasehold improvements and property improvements) and capitalized

software expenditures. The adjustments associated with non-fleet fixed assets and capitalized software primarily relate to the Company’s

identification of (1) expenditures that were capitalized rather than expensed, (2) the failure to write off abandoned projects included in construction

in progress on a timely basis, (3) the failure to write off of assets no longer in service, and (4) depreciation adjustments associated with assets

that should have been placed in service at a date that preceded the placed-in-service date, including assets that had not yet been transferred from

construction in progress to in service. Inappropriate tone at the top, among other factors, may have contributed to this restatement matter.

(j) Brazil Adjustments (International Car Rental) - This restatement matter relates to the Brazilian operations of the International Car Rental

business. Allowances for uncollectible balances were calculated using inappropriate methodologies, and certain assets, reserves for legal

expenses and litigation, and intercompany account balances were not properly supported and consequently were written off. Inappropriate tone at

the top, among other factors, may have contributed to this restatement matter.

(k) Cash reclassifications (All Segments) - The Company reclassified negative cash balances representing outstanding checks to accounts

payable at period end despite, in some cases, the existence of bank agreements with legal right of offset against cash balances with the same

banks.

179

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.