Hertz 2014 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2014 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Hertz Global Holdings, Inc. (the "Company" or "Hertz Holdings") was incorporated in Delaware in 2005 and wholly owns Hertz Investors, Inc. which

wholly owns The Hertz Corporation, Hertz Holdings' primary operating company.

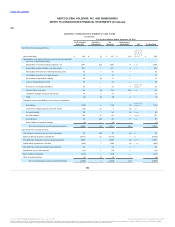

These condensed parent company financial statements have been prepared in accordance with Rule 12-04, Schedule 1 of Regulation S-X, as the

restricted net assets of Hertz Holdings and its subsidiaries exceed 25% of the consolidated net assets of the Company. This information should

be read in conjunction with the consolidated financial statements of Hertz included in this Annual Report under the caption Item 8, "Financial

Statements and Supplementary Data."

As discussed in Note 2, "Restatement," to the Notes to the consolidated financial statements of the Company included in this Annual Report under

the caption Item 8, "Financial Statements and Supplementary Data" ("Note 2"), this Note 2 to the consolidated financial statements discloses the

nature of the restatement matters and adjustments and shows the impact of the restatement matters on revenues, expenses, income, assets,

liabilities, equity, and cash flows from operating activities, investing activities, and financing activities, and the cumulative effects of these

adjustments on the consolidated statement of operations, balance sheet, and cash flows for 2012 and 2013. In addition, this Note shows the

effects of the adjustment to opening retained earnings as of January 1, 2012, which adjustment reflects the impact of the restatement on periods

prior to 2012. The cumulative impact of the out of period misstatements for all previously reported periods through December 31, 2013, including

amounts associated with the revision previously reported in the 2013 Form 10-K/A, was approximately a $349 million reduction in pre-tax income

and $231 million reduction in net income. The cumulative annual impact on 2012 and 2013 was a reduction in pre-tax income and net income of

$90 million and $62 million for 2012 and $72 million and $51 million for 2013. Excluding the revision included in the 2013 Form 10-K/A of $26

million on a pre-tax basis and $17 million on an after-tax basis, approximately $160 million on a pre-tax basis and $100 million on an after-tax basis

is included as a reduction to opening retained earnings as of January 1, 2012.

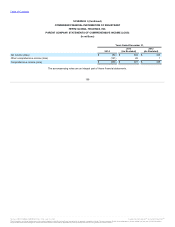

In 2014, the Company changed its method of calculating the market-related value of pension assets for purposes of determining the expected

return on plan assets and accounting for asset gains and losses. The change in accounting principle was applied retroactively to December 2005.

The change in accounting principle increased pre-tax income and net income by $5 million and $3 million in 2012 and by $12 million and $7 million

in 2013, respectively.

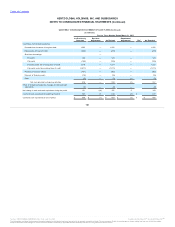

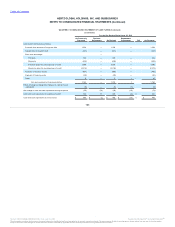

The restatement adjustments and change in accounting principle were recorded at the various subsidiaries of the Company. The impact of the

above to these parent only financial statements was as follows:

• A reduction in the balance of investments in subsidiaries and in equity in 2013 of $204 million;

• A reduction in the equity in earnings (loss) of subsidiaries, net of tax of $54 million and $44 million in 2012 and 2013, respectively; and

• No impact on operating, investing or financing cash flows in 2012 or 2013.

In 2009, Hertz Holdings issued $475 million in aggregate principal amount 5.25% convertible senior notes due June 2014 (“Convertible Senior

Notes”). The Company's Convertible Senior Notes were convertible by holders into shares of its common stock, cash or a combination of cash and

shares of its common stock, as elected by the Company, initially at a conversion rate of 120.6637 shares per $1,000 principal amount of notes,

subject to adjustment.

In January 2013, a conversion right was triggered because the Company's closing common stock price per share exceeded $10.77 for at least 20

trading days during the 30 consecutive trading day period ending on December 31, 2012.

In August 2013, the Company entered into privately negotiated agreements with certain holders of approximately $390 million in aggregate principal

amount of its Convertible Senior Notes providing for conversion at a rate of 120.6637 shares of Hertz Holdings' common stock for each $1,000 in

principal amount of Convertible Senior Notes (with cash delivered in lieu of any fractional shares), which resulted in Hertz Holdings issuing an

aggregate of approximately 47

201

Source: HERTZ GLOBAL HOLDINGS INC, 10-K, July 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.