Dollar General 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.97

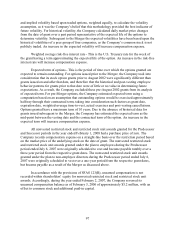

and implied volatility based upon traded options, weighted equally, to calculate the volatility

assumption, as it was the Company’ s belief that this methodology provided the best indicator of

future volatility. For historical volatility, the Company calculated daily market price changes

from the date of grant over a past period representative of the expected life of the options to

determine volatility. Subsequent to the Merger the expected volatilities have been based upon the

historical volatilities of a peer group of four companies, as the Company’ s common stock is not

publicly traded. An increase in the expected volatility will increase compensation expense.

Weighted average risk-free interest rate - This is the U.S. Treasury rate for the week of

the grant having a term approximating the expected life of the option. An increase in the risk-free

interest rate will increase compensation expense.

Expected term of options - This is the period of time over which the options granted are

expected to remain outstanding. For options issued prior to the Merger, the Company took into

consideration that its stock option grants prior to August 2002 were significantly different than

grants issued on and after that date, and therefore that the historical and post-vesting employee

behavior patterns for grants prior to that date were of little or no value in determining future

expectations. As a result, the Company excluded these pre-August 2002 grants from its analysis

of expected term. For pre-Merger options, the Company estimated expected term using a

computation based on an assumption that outstanding options would be exercised approximately

halfway through their contractual term, taking into consideration such factors as grant date,

expiration date, weighted-average time-to-vest, actual exercises and post-vesting cancellations.

Options granted have a maximum term of 10 years. Due to the absence of historical data for

grants issued subsequent to the Merger, the Company has estimated the expected term as the

mid-point between the vesting date and the contractual term of the option. An increase in the

expected term will increase compensation expense.

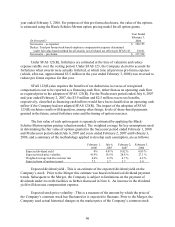

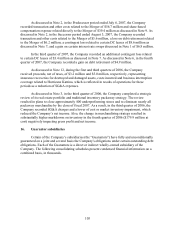

All nonvested restricted stock and restricted stock unit awards granted for the Predecessor

and Successor periods in the year ended February 1, 2008 had a purchase price of zero. The

Company records compensation expense on a straight-line basis over the restriction period based

on the market price of the underlying stock on the date of grant. The nonvested restricted stock

and restricted stock unit awards granted under the plan to employees during the Predecessor

period ended July 6, 2007 were originally scheduled to vest and become payable ratably over a

three-year period from the respective grant dates. The nonvested restricted stock unit awards

granted under the plan to non-employee directors during the Predecessor period ended July 6,

2007 were originally scheduled to vest over a one-year period from the respective grant dates,

but became payable as a result of the Merger as discussed above.

In accordance with the provisions of SFAS 123(R), unearned compensation is not

recorded within shareholders’ equity for nonvested restricted stock and restricted stock unit

awards. Accordingly, during the year ended February 2, 2007, the Company reversed its

unearned compensation balance as of February 3, 2006 of approximately $5.2 million, with an

offset to common stock and additional paid-in capital.