Dollar General 2007 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.160

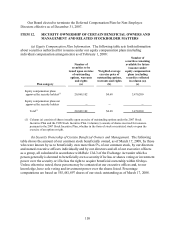

(6) Includes the following number of shares held by the following entities: Buck Co-Investor I, LLC

(17,933,540); Buck Co-Investor II, LLC (827,780); Buck Co-Investor III, LLC (7,365,100); Buck Co-

Investor IV, LLC (5,822,740); Buck Co-Investor V, LLC (2,201,580); Buck Co-Investor VI, LLC

(499,900), Buck Co-Investor VII, LLC (2,252,700), Buck Co-Investor VIII, LLC (445,820), Buck Co-

Investor IX, LLC (281,560), Buck Co-Investor X, LLC (609,280), Buck Co-Investor XI, LLC

(1,160,000), Buck Co-Investor XII, LLC (476,000), and Buck Co-Investor XIII, LLC (124,000). The

address of Wellington Management Company, LLP is 75 State Street, Boston, Massachusetts 02109.

(7) Messrs. Calbert and Agrawal are our directors and are executives of KKR, and as such may be deemed

to share beneficial ownership of any shares beneficially owned by KKR, but disclaim such beneficial

ownership except to the extent of their pecuniary interest in those shares.

(8) Mr. Jones is our director and an executive of GS Capital Partners, but disclaims any beneficial

ownership except to the extent of his pecuniary interest in those shares.

(9) Represents shares of restricted common stock that were unvested as of March 17, 2008 over which the

named holder does not have investment power until the vesting of those shares.

(10) Includes the following number of shares subject to options either currently exercisable or exercisable

within 60 days of March 17, 2008 over which the person will not have voting or investment power

until the options are exercised: Mr. Dreiling (250,000); Mr. Beré (273,712); Mr. Tehle (302,007);

Mr. Buley (288,797); Ms. Guion (220,286); Ms. Lowe (173,200); and all current directors and

executive officers as a group (1,930,628). The shares described in this note are considered outstanding

for the purpose of computing the percentage of outstanding stock owned by each named person and by

the group, but not for the purpose of computing the percentage ownership of any other person.

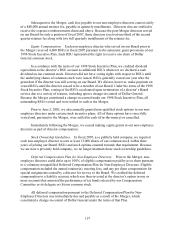

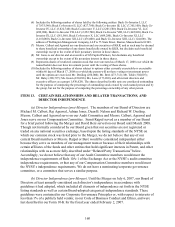

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND

DIRECTOR INDEPENDENCE

(a) Director Independence (post-Merger). The members of our Board of Directors are

Michael M. Calbert, Raj Agrawal, Adrian Jones, Dean B. Nelson and Richard W. Dreiling.

Messrs. Calbert and Agrawal serve on our Audit Committee and Messrs. Calbert, Agrawal and

Jones serve on our Compensation Committee. Sumit Rajpal served as a member of our Board

for a brief period following the Merger and David Beré served on our Board until March 2008.

Though not formally considered by our Board given that our securities are not registered or

traded on any national securities exchange, based upon the listing standards of the NYSE on

which our common stock was listed prior to the Merger, we do not believe that any of our

current Board members or Messrs. Rajpal or Beré would be considered independent either

because they serve as members of our management team or because of their relationships with

certain affiliates of the funds and other entities that hold significant interests in Parent, and other

relationships with us as more fully described under “Related Party Transactions” below.

Accordingly, we do not believe that any of our Audit Committee members would meet the

independence requirements of Rule 10A-1 of the Exchange Act or the NYSE’ s audit committee

independence requirements, or that any of our Compensation Committee members would meet

the NYSE’ s independence requirements. We do not have a nominating/corporate governance

committee, or a committee that serves a similar purpose.

(b) Director Independence (pre-Merger). Until the Merger on July 6, 2007, our Board of

Directors at least annually considered each director’ s independence in accordance with

guidelines it had adopted, which included all elements of independence set forth in the NYSE

listing standards as well as certain Board-adopted categorical independence standards. These

guidelines were contained in our Corporate Governance Principles or, with respect to interests of

less than 1% of a publicly held vendor, in our Code of Business Conduct and Ethics, and were

last described in our Form 10-K for the fiscal year ended February 2, 2007.