Dollar General 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

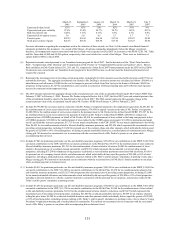

The Committee reviewed benchmarking data provided by Hewitt of a market comparator

group substantially similar to the group used for purposes of 2007 compensation decisions (with

the addition of Payless Shoe Source, Retail Ventures and Big Lots and the removal of Office

Depot and RadioShack). This benchmarking data showed that there was a significant movement

in the market median for Ms. Guion’ s position and, as a result, the Committee adjusted her pay

accordingly. The Committee approved 3% base salary increases for all NEOs (other than Mr.

Dreiling, who did not receive a base salary increase since he was hired shortly before the end of

the 2007 fiscal year, and Ms. Guion, who received an approximate 15.5% base salary increase

for the reason discussed above) in order to maintain base salaries at the median of the market

comparator group.

Short-Term Incentive Plan. Our short-term incentive plan, called Teamshare, serves to

motivate NEOs to achieve certain objective financial goals that are established early in the fiscal

year. As is the case with base salary, as a threshold matter an NEO may not receive a Teamshare

payout unless he or she receives a satisfactory overall performance evaluation, even if the

Teamshare financial goal is attained. Accordingly, Teamshare fulfills a part of our pay for

performance philosophy while aligning our NEOs’ and shareholders’ interests. Teamshare also

helps us meet our recruiting and retention objectives by providing compensation opportunities

that are consistent with those prevalent in our market comparator group.

(a) 2007 Teamshare Structure. Teamshare authorizes the payment of cash bonuses,

calculated as a percentage of base salary, based on our performance measured against a financial

performance measure established early in the fiscal year. “Threshold,” “target” and “maximum”

performance goals are set, along with corresponding potential payout percentages. Payouts are

prorated between threshold and maximum levels in relation to actual performance results.

In 2007, the Compensation Committee had decided to re-evaluate its historical use of net

income as the Teamshare performance measure given changes in our business strategy, but

before that evaluation could occur we announced the proposed Merger and agreed to consult

with KKR on significant changes to certain of our normal business practices. KKR requested,

and the Committee agreed, to adopt a metric based principally upon earnings before interest,

taxes, depreciation and amortization (EBITDA) as the sole 2007 Teamshare performance

measure. After discussions with KKR, the Committee set this performance target for 2007 at

$570 million, which was equal to our annual financial objective. Consistent with prior practice

and after consultation with KKR, the Committee also set the threshold and maximum levels at

90% and 110%, respectively, of the target level. The Committee considered the Teamshare

performance target to be challenging and generally consistent with the level of difficulty of

achievement associated with our performance-based awards for prior years. We did not achieve

the threshold Teamshare performance level in fiscal years 2006 or 2005. We achieved

Teamshare performance levels between threshold and target in fiscal years 2004 and 2002 and at

maximum in fiscal year 2003.