Dollar General 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

Reclassifications

Certain reclassifications of the 2006 amounts have been made to conform to the 2007

presentation.

2. Merger

On March 11, 2007, the Company entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with Buck Holdings L.P., a Delaware limited partnership (“Parent”), and

Buck, a Tennessee corporation and wholly owned subsidiary of Parent. Parent is and Buck was

(prior to the Merger) controlled by investment funds affiliated with Kohlberg Kravis Roberts &

Co., L.P. (“KKR”). On July 6, 2007, the transaction was consummated through a merger (the

“Merger”) of Buck with and into the Company. The Company survived the Merger as a

subsidiary of Parent. The Company’ s results of operations after July 6, 2007 include the effects

of the Merger.

The aggregate purchase price was approximately $7.1 billion, including direct costs of

the Merger, and was funded primarily through debt financings as described more fully below in

Note 6 and cash equity contributions from KKR, GS Capital Partners VI Fund, L.P. and

affiliated funds (affiliates of Goldman, Sachs & Co.), Citi Private Equity, Wellington

Management Company, LLP, CPP Investment Board (USRE II) Inc., and other equity co-

investors (collectively, the “Investors”) of approximately $2.8 billion (553.4 million shares of

new common stock, $0.50 par value per share, valued at $5.00 per share). Also in connection

with the Merger, certain of the Company’ s management employees invested, and were issued

new shares representing less than 1% of the outstanding shares, in the Company. Pursuant to the

terms of the Merger Agreement, the former holders of the Company’ s common stock, par value

$0.50 per share, received $22.00 per share, or approximately $6.9 billion, and all such shares

were acquired as a result of the Merger. As of February 1, 2008, there were approximately

555,481,897 shares of Company common stock outstanding, a portion of which is redeemable as

further discussed below in Note 9.

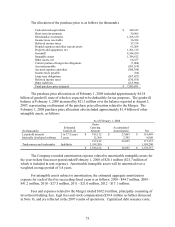

As discussed in Note 1, the Merger was accounted for as a reverse acquisition in

accordance with the purchase accounting provisions of SFAS 141, “Business Combinations”.

Because of this accounting treatment, the Company’ s assets and liabilities have properly been

accounted for at their estimated fair values as of the Merger date. The aggregate purchase price

has been allocated to the tangible and intangible assets acquired and liabilities assumed based

upon an assessment of their relative fair values as of the Merger date.