Dollar General 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.95

for accounting purposes, under SFAS 123(R) such options are not considered vested until the

expiration of the Company’ s call option (July 6, 2012). Accordingly, all references to the

vesting provisions or vested status of the options discussed in this note give effect to the vesting

pursuant to the provisions of SFAS 123(R) and may differ from descriptions of the vesting status

of the Time Options and Performance Options located elsewhere in the Company’ s Annual

Report on Form 10-K.

Each of the Company’ s management-owned shares, Rollover Options, and vested new

options include certain provisions by which the holder of such shares, Rollover Options, or

vested new options may require the Company to repurchase such instruments in limited

circumstances. Specifically, each such instrument is subject to a repurchase right for a period of

365 days after termination due to the death or disability of the holder of the instrument that

occurs within five years from the closing date of the Merger. In such circumstances, the holder

of such instruments may require the Company to repurchase any shares at the fair market value

of such shares and any Rollover Options or vested new options at a price equal to the intrinsic

value of such rollover or vested new options. Because the Company does not have control over

the circumstances in which it may be required to repurchase the outstanding shares or Rollover

Options, such shares and Rollover Options, valued at a fair value and intrinsic value of $6.0

million and $3.2 million, respectively, have been classified as Redeemable common stock in the

accompanying consolidated balance sheet at February 1, 2008. Because redemption of such

shares is uncertain, such shares are not subject to re-measurement until their redemption becomes

probable.

In addition to the repurchase rights upon death or disability that are common to all

management held shares, Rollover Options, and vested new options, the management

stockholder’ s agreement which the Company entered into with certain executive officers

provides such officers with an additional repurchase right in the event their employment

terminates for any reason prior to July 21, 2008. Such executive officers may require the

Company to repurchase their outstanding shares and Rollover Options at a price of $5 per share

in the case of shares and the difference in $5 per share and the exercise price of any Rollover

Options that they hold. This repurchase right exists for a period of 365 days following their

termination within the required timeframe. As noted above, each of the shares, whether held by

general members of management or executive officers, has been classified within Redeemable

common stock on the accompanying consolidated balance sheet as of February 1, 2008. In the

case of the Rollover Options held by the executive officers, however, the additional repurchase

rights in the event of their termination prior to July 21, 2008 are considered within the control of

the employee, and as such, $3.6 million (representing the fixed repurchase price) related to such

Rollover Options have been classified in Other (noncurrent) liabilities in the accompanying

consolidated balance sheet at February 1, 2008 pursuant to SFAS 123(R).

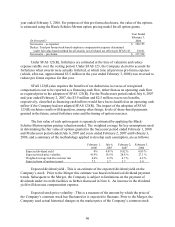

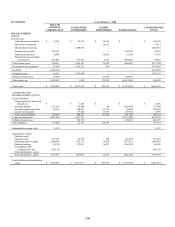

The Company adopted SFAS 123(R) effective February 4, 2006 and began recognizing

compensation expense for stock options based on the fair value of the awards on the grant date.

The Company adopted SFAS 123(R) under the modified-prospective-transition method and,

therefore, results from prior periods have not been restated. The following table illustrates the

effect on net income and earnings per share as if the Company had applied the fair value

recognition provisions of SFAS 123 to options granted under the Company’ s stock plans for the