Dollar General 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.123

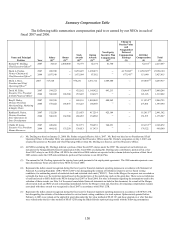

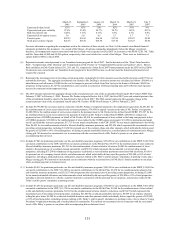

Teamshare payout in the amount reflected in the “Non-Equity Incentive Plan Compensation”

column of the Summary Compensation Table at the following percentages of base salary: Mr.

Dreiling, 127% (based on an annualization of his partial fiscal 2007 salary); Mr. Beré, 140%;

and Mr. Tehle, Mr. Buley, Ms. Guion and Ms. Lowe, 82.6%.

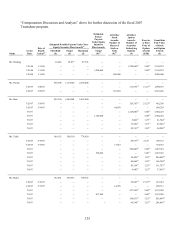

Long-Term Incentive Program. Long-term equity incentives motivate NEOs to focus

on long-term success for shareholders. These incentives also provide a balance between short-

term and long-term goals. Prior to the Merger, we delivered these incentives as equity grants

structured to recognize stock price changes. The Compensation Committee targeted a certain

economic value to be delivered through these incentives which an NEO would realize only if our

stock price increased. Long-term incentives are also important to our compensation program’ s

recruiting and retention objectives because most of the companies in our market comparator

group offer them. Following the Merger, our long-term incentives are designed to compensate

NEOs for a long-term commitment to us, while motivating sustained increases in our financial

performance.

Prior to the Merger, the Committee typically made equity grant decisions when it

reviewed other compensation decisions and evaluated NEO performance, and it was our practice

to establish option exercise prices as the closing market price on the grant date. We typically

released our annual earnings and other financial results shortly thereafter, but the grants were

made regardless of whether earnings were favorable or unfavorable. In accordance with our

usual practice, the Committee made pre-Merger 2007 annual equity grant decisions prior to the

annual earnings release but after the announcement of the proposed Merger.

Because Hewitt’ s benchmarking data indicated that our target long-term incentive values

for NEOs (other than Mr. Perdue) were significantly below the median of our market comparator

group, the Committee decided in fiscal 2006 to increase that value by approximately 20-25% for

fiscal 2006 compensation. At the same time, the Committee also decided to change the

options/restricted stock units (“RSUs”) allocation from the previous 80%/20% to 70%/30% for

fiscal 2006 compensation, which, according to Hewitt, more closely aligned with market

practice. In 2007, the Committee decided to further adjust the relationship of options and RSUs

to reflect a 50%/50% allocation of the economic value for 2007 long-term incentive grants which

Hewitt advised continued to further align with market practice.

The Committee’ s decision regarding the 2007 equity grant mix also took into account the

limited availability of shares for use under the shareholder-approved option program existing at

that time. If the options/RSUs mix continued unchanged from 2006, there likely would not have

been enough shares for equity grants through fiscal 2008, the year the plan was scheduled to

terminate by its terms. The Committee believed the best way to address that issue, while also

assisting with retention and motivation of NEOs and maintaining alignment with shareholder

interests, was to adjust the options/RSUs grant mix.

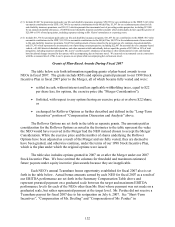

In connection with the Merger, all outstanding equity awards became fully vested and

were settled in cash, canceled or rolled over, as described below. Unless they elected to roll over

their existing options, each NEO received in exchange for each option an amount in cash,

without interest and less applicable withholding taxes, equal to $22.00 less the exercise price of