Dollar General 2007 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

155

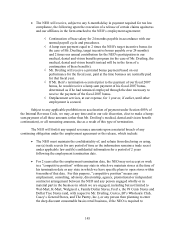

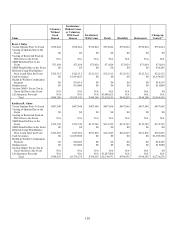

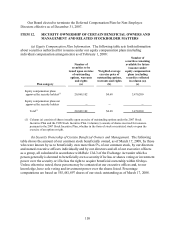

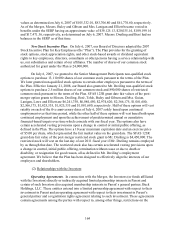

Fiscal 2007 Director Compensation

Name(1)

Fees

Earned

or

Paid in

Cash

($)(2)

Stock

Awards

($)(3)(4)(5)

Option

Awards

($)(5)(6)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension Value

and Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)(7)

Total

($)

Raj Agrawal 23,333 - - - - - 23,333

Michael M. Calbert 23,333 - - - - - 23,333

Adrian Jones 23,333 - - - - - 23,333

Dean B. Nelson 23,333 - - - - - 23,333

Sumit Rajpal - - - - - - -

Dennis C. Bottorff 38,625 124,353 - - - - 162,978

Barbara L. Bowles 33,625 124,353 - - - - 157,978

Reginald D. Dickson 22,500 124,353 - - - - 146,853

E. Gordon Gee 23,750 124,353 - - - - 148,103

Barbara M. Knuckles 22,500 124,353 - - - - 146,853

J. Neal Purcell 26,750 124,353 - - - - 151,103

James D. Robbins 35,500 124,353 - - - - 159,853

Richard E. Thornburgh 23,125 129,628 - - - - 152,753

David M. Wilds 36,250 124,353 - - - - 160,603

(1) Pursuant to the terms of the Merger Agreement, on July 6, 2007 each of Messrs. Agrawal, Calbert, Jones and Rajpal

joined our Board and each of Messrs. Bottorff, Dickson, Gee, Purcell, Robbins, Thornburgh and Wilds and Mss.

Bowles and Knuckles ceased to serve on our Board. Mr. Rajpal resigned from our Board effective September 19,

2007 and received no compensation for his Board service. Mr. Nelson was appointed to our Board on July 20, 2007.

(2) Each of Messrs. Purcell and Thornburgh deferred payments of all his fiscal 2007 director fees pursuant to the terms of

our Deferred Compensation Plan for Non-Employee Directors.

(3) These amounts represent restricted stock units (“RSUs”) granted during fiscal 2007 and prior fiscal years under the

1998 Stock Incentive Plan. The amounts equal the compensation cost recognized during fiscal 2007 for financial

statement purposes in accordance with Statement of Financial Accounting Standards 123R (“SFAS 123R”), except

forfeitures related to service-based vesting conditions were disregarded. Additional information related to the

calculation of the compensation cost is set forth in Note 9 of the annual consolidated financial statements included in

this report. As a result of the Merger, all outstanding RSU awards vested and, therefore, all compensation expense

associated with such awards was recognized in fiscal 2007 in accordance with SFAS 123(R).

(4) Each person who served as a non-employee director on June 5, 2007 received 4,600 RSUs during fiscal 2007 under

the automatic grant provisions of the 1998 Stock Incentive Plan. The grant date fair value computed in accordance

with SFAS 123R for those RSUs was $99,360.

(5) No director listed in this table had stock awards or option awards outstanding at February 1, 2008. As a result of the

Merger, each director who held RSUs received $22.00 in cash, without interest and less applicable withholding

taxes, and each director listed in this table who held options received an amount in cash, without interest and less

applicable withholding taxes, equal to $22.00 less the exercise price of each in-the-money option. No director

forfeited any RSUs or options during fiscal 2007.

(6) No compensation expense was recorded in fiscal 2007 for options held by directors because no options were granted

to these directors during fiscal 2007 and all options awarded in prior years had previously vested.

(7) Perquisites and personal benefits, if any, totaled less than $10,000 per director.