Dollar General 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85

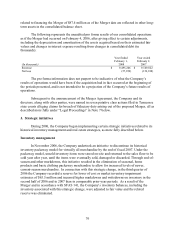

The notes are fully and unconditionally guaranteed by each of the existing and future

direct or indirect wholly owned domestic subsidiaries that guarantee the obligations under the

Company’ s New Credit Facilities.

The Company may redeem some or all of the notes at any time at redemption prices

described or set forth in the indentures. During the fourth quarter of fiscal 2007, we repurchased

$25.0 million of the 11.875%/12.625% senior subordinated toggle notes due 2017, resulting in a

pretax gain of $4.9 million.

The indentures contain certain covenants, including, among other things, covenants that

limit the Company’ s ability to incur additional indebtedness, create liens, sell assets, enter into

transactions with affiliates, or consolidate or dispose of all of its assets.

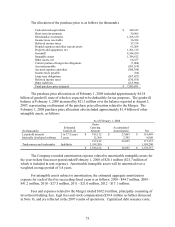

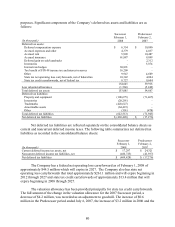

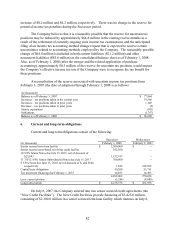

Scheduled debt maturities for the Company’ s fiscal years listed below are as follows (in

thousands): 2008 - $3,246; 2009 - $13,009; 2010 - $25,171; 2011 - $23,254; 2012 - $23,272;

thereafter - $4,216,034.

On July 6, 2007, immediately after the completion of the Merger, the Company

completed a cash tender offer to purchase any and all of its $200 million principal amount of

8 5/8% Notes due June 2010 (the “2010 Notes”). Approximately 99% of the 2010 Notes were

validly tendered and accepted for payment. The tender offer included a consent payment equal

to 3% of the par value of the 2010 Notes, and such payments along with associated settlement

costs totaling $6.2 million were paid and reflected as a loss on debt retirement in the 2007

Successor period presented. Additionally, because the Company received the requisite consents

to the proposed amendments to the indenture pursuant to which the 2010 Notes were issued, a

supplemental indenture to effect such amendments was executed and delivered. The

amendments, which eliminated substantially all of the restrictive covenants contained in the

indenture, became operative upon the purchase of the tendered 2010 Notes.

7. Commitments and contingencies

Leases

As of February 1, 2008, the Company was committed under capital and operating lease

agreements and financing obligations for most of its retail stores, three of its DCs, and certain of

its furniture, fixtures and equipment. The majority of the Company’ s stores are subject to short-

term leases (an average of three to five years) with multiple renewal options when available.

The Company also has stores subject to build-to-suit arrangements with landlords, which

typically carry a primary lease term of 10 years with multiple renewal options. Approximately

44% of the stores have provisions for contingent rentals based upon a percentage of defined sales

volume. Certain leases contain restrictive covenants. As of February 1, 2008, the Company is

not aware of any material violations of such covenants, however, there is a degree of uncertainty

with regard to the Company’ s DC leases as discussed below.

The Merger and certain of the related financing transactions may be interpreted as giving

rise to certain trigger events (which may include events of default) under the Company’ s three