Dollar General 2007 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.157

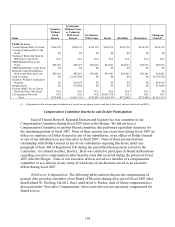

Subsequent to the Merger, cash fees payable to our non-employee directors consist solely

of a $40,000 annual retainer fee, payable in quarterly installments. Directors also are entitled to

receive the expense reimbursements discussed above. Because the post-Merger directors served

on our Board for only a portion of fiscal 2007, those directors received one-third of the second

quarter retainer fee along with two full quarterly installments of the retainer fee.

Equity Compensation. Each non-employee director who served on our Board prior to

the Merger received 4,600 RSUs in fiscal 2007 pursuant to the automatic grant provisions of our

1998 Stock Incentive Plan. Each RSU represented the right to receive one share of Dollar

General common stock.

In accordance with the terms of our 1998 Stock Incentive Plan, we credited dividend

equivalents to the director’ s RSU account as additional RSUs whenever we declared a cash

dividend on our common stock. Directors did not have voting rights with respect to RSUs until

the underlying shares of common stock were issued. RSUs generally vested one year after the

grant date if the director was still serving on our Board. We did not, however, make payment on

vested RSUs until the director ceased to be a member of our Board. Under the terms of the 1998

Stock Incentive Plan, vesting of the RSUs accelerated upon termination of a director’ s Board

service due to a variety of reasons, including upon a change-in-control of Dollar General.

Because the Merger constituted a change-in-control under our 1998 Stock Incentive Plan, all

outstanding RSUs vested and were settled in cash in the Merger.

Prior to June 2, 2003, we also annually granted non-qualified stock options to our non-

employee directors under certain stock incentive plans. All of those options have since fully

vested and, pursuant to the Merger, were settled in cash (if in-the-money) or cancelled.

Immediately following the Merger, we ceased making equity grants to our non-employee

directors as part of director compensation.

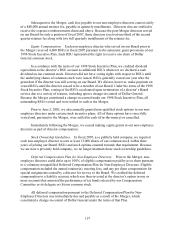

Stock Ownership Guidelines. In fiscal 2007, as a publicly held company, we required

each non-employee director to own at least 13,000 shares of our common stock within three

years of joining our Board. RSUs and stock options counted towards that requirement. Because

we are now a privately held company, we no longer maintain those stock ownership guidelines.

Deferred Compensation Plan for Non-Employee Directors. Prior to the Merger, non-

employee directors could defer up to 100% of eligible compensation paid by us to them pursuant

to a voluntary nonqualified Deferred Compensation Plan for Non-Employee Directors. Eligible

compensation included the annual retainer(s), meeting fees, and any per diem compensation for

special assignments earned by a director for service to the Board. We credited the deferred

compensation to a liability account, which was then invested at the director’ s option in one or

more accounts that mirrored the performance of (a) funds selected by our Compensation

Committee or its delegate or (b) our common stock.

All deferred compensation pursuant to the Deferred Compensation Plan for Non-

Employee Directors was immediately due and payable as a result of the Merger, which

constituted a change-in-control of Dollar General under the terms of that Plan.