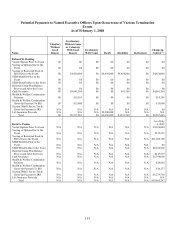

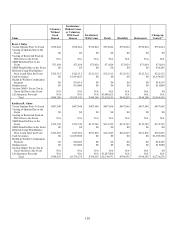

Dollar General 2007 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.143

• The 20% portion of the time-based options that would have become exercisable on

the next anniversary date of the Merger if the NEO had remained employed with us

through that date will become vested and exercisable.

• The 20% portion of the performance-based options that would have become

exercisable in respect of the fiscal year in which the NEO’ s employment terminates if

the NEO had remained employed with us through that date, will remain outstanding

through the date we determine whether the applicable performance targets are met for

that fiscal year. If the performance targets are met for that fiscal year, that 20%

portion of the performance-based options will become exercisable on such

performance-vesting determination date. Otherwise, that 20% portion will be

forfeited.

• All unvested options will be forfeited, and vested options generally may be exercised

(by the employee’ s survivor in the case of death) for a period of 1 year (3 years in the

case of Rollover Options) from the service termination date unless we purchase such

vested options in total at the fair market value less the exercise price.

In the event of Mr. Dreiling’ s death or disability, his restricted stock will vest and, in the

event of disability, he will receive a prorated bonus payment based on our performance for the

fiscal year, paid at the time bonuses are normally paid for that fiscal year.

In the event of death, the NEO's beneficiary will receive payments under our group life

insurance program in an amount, up to a maximum of $3 million, equal to 2.5 times the NEO's

annual base salary. We have excluded from the tables below amounts that the NEO would

receive under our disability insurance program since the same benefit level is provided to all of

our salaried employees. The NEO's CDP/SERP Plan benefit also becomes fully vested and is

payable in a lump sum within 60 days after the end of the calendar quarter in which the NEO's

death occurs.

In the event of disability, the NEO’ s CDP/SERP Plan benefit becomes fully vested and is

payable in a lump sum within 60 days after the end of the calendar quarter in which we receive

notification of the determination of the NEO's disability by the Social Security Administration.

For purposes of the NEOs' employment agreements, "disability" means the that employee

must be disabled for purposes of our long-term disability insurance plan. For purposes of the

CDP/SERP Plan, “disability” means total and permanent disability for purposes of entitlement to

Social Security disability benefits.

Payments Upon Voluntary Termination

The payments to be made to an NEO upon voluntary termination vary depending upon

whether the NEO resigns with or without "good reason" or after our failure to offer to renew,

extend or replace the NEO's employment agreement under certain circumstances. For purposes

of each NEO, "good reason" generally means (as more fully described in the applicable

employment agreement):