Dollar General 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

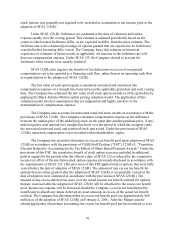

80

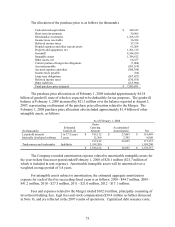

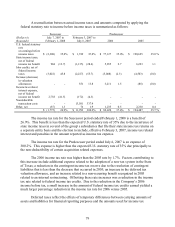

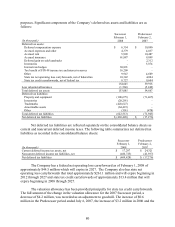

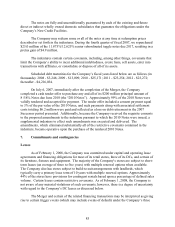

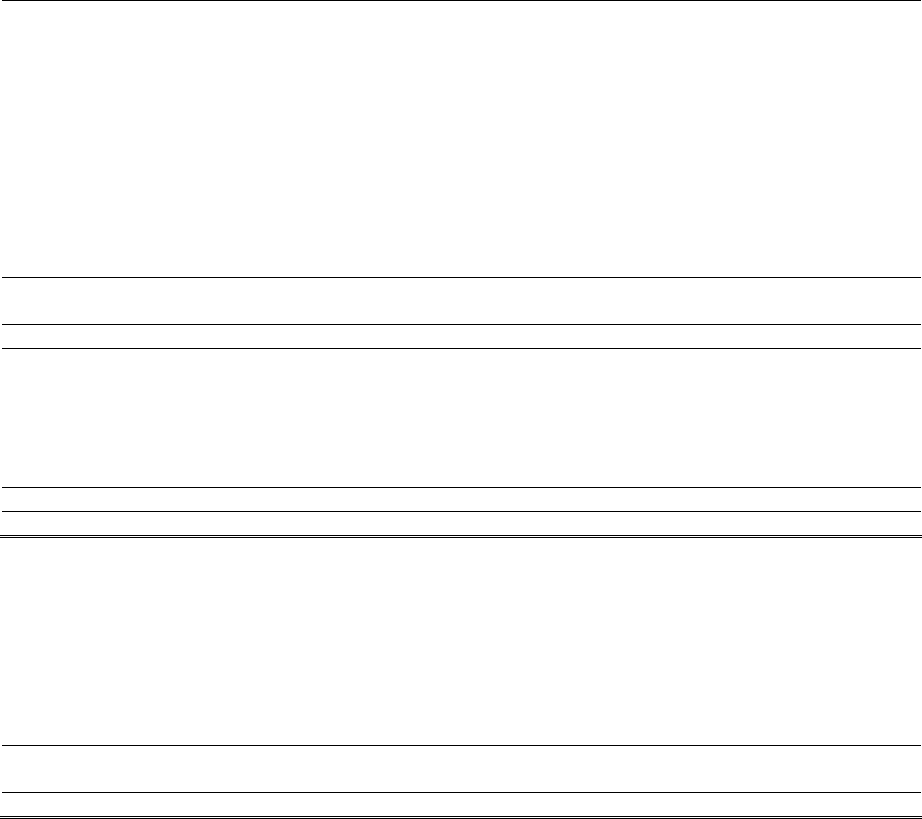

purposes. Significant components of the Company’ s deferred tax assets and liabilities are as

follows:

(In thousands)

Successor

February 1,

2008

Predecessor

February 2,

2007

Deferred tax assets:

Deferred compensation expense $ 6,354 $ 10,090

Accrued expenses and other 4,379 4,037

Accrued rent 5,909 10,487

Accrued insurance 61,887 9,899

Deferred gain on sale/leasebacks - 2,312

Inventories - 5,874

Interest rate hedges 30,891 -

Tax benefit of FIN 48 income tax and interest reserves 16,209 -

Other 9,947 4,609

State tax net operating loss carryforwards, net of federal tax 10,342 4,004

State tax credit carryforwards, net of federal tax 8,727 8,604

154,645 59,916

Less valuation allowances (1,560) (5,249)

Total deferred tax assets 153,085 54,667

Deferred tax liabilities:

Property and equipment (108,675) (71,465)

Inventories (20,291) -

Trademarks (428,627) -

Amortizable assets (64,419) -

Other (501) (478)

Total deferred tax liabilities (622,513) (71,943)

Net deferred tax liabilities $ (469,428) $ (17,276)

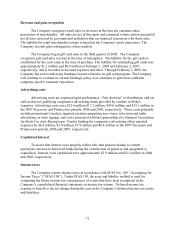

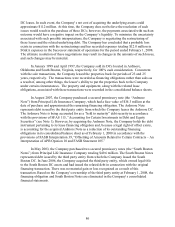

Net deferred tax liabilities are reflected separately on the consolidated balance sheets as

current and noncurrent deferred income taxes. The following table summarizes net deferred tax

liabilities as recorded in the consolidated balance sheets:

(In thousands)

Successor

February 1,

2008

Predecessor

February 2,

2007

Current deferred income tax assets, net $ 17,297 $ 24,321

Noncurrent deferred income tax liabilities, net (486,725) (41,597)

Net deferred tax liabilities $ (469,428) $ (17,276)

The Company has a federal net operating loss carryforward as of February 1, 2008 of

approximately $44.5 million which will expire in 2027. The Company also has state net

operating loss carryforwards that total approximately $261.1 million and will expire beginning in

2012 through 2027 and state tax credit carryforwards of approximately $13.4 million that will

expire beginning in 2008 through 2027.

The valuation allowance has been provided principally for state tax credit carryforwards.

The full amount of the change in the valuation allowance for the 2007 Successor period, a

decrease of $4.2 million, was recorded as an adjustment to goodwill. The increase of $0.6

million in the Predecessor period ended July 6, 2007, the increase of $3.2 million in 2006 and the