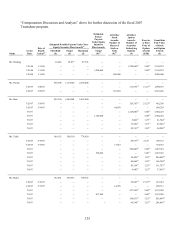

Dollar General 2007 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.139

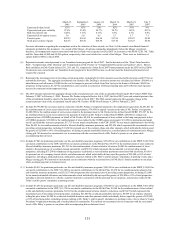

as a joint and 50% spouse annuity assuming his spouse to be the same age as Mr. Perdue.

Mr. Perdue could elect to receive his benefit as a lump sum or any annuity form actuarially

equivalent to the normal retirement benefit. The SERP also provided for an early retirement

benefit which would reduce his benefit by 5% for each year or portion thereof that Mr. Perdue

retired prior to age 60.

For the purpose of calculating Mr. Perdue’ s accumulated benefit, “normal retirement

date” is the first of the month coincident with or next following the later of the date Mr. Perdue

attains age 60 or is credited with 15 years of credited service. Since Mr. Perdue was not age 60

on the date of his resignation, his benefit under the SERP was treated as an early retirement and

his benefit was reduced accordingly.

Mr. Perdue’ s benefit was based on a total of 14 out of a possible 15 years of credited

service under the SERP plan. This included 8 years of credited service based on his actual

service under the plan in which he received 2 years of credited service upon each anniversary of

his date of hire and an additional 6 years of credited service since his resignation was for good

reason within 2 years of a change-in-control.

“Final average compensation” is calculated as Mr. Perdue’ s base salary plus his

“applicable annual bonus” for the highest 3 consecutive fiscal years of credited service.

“Applicable annual bonus” is the greater of the actual bonus paid for the immediately preceding

fiscal year or the target annual bonus for the current fiscal year. Mr. Perdue’ s base salary and

“applicable annual bonus” were assumed to have been paid during the additional years of

credited service for the purpose of calculating his “final average compensation”. For the purpose

of his benefit calculation, Mr. Perdue’ s final average compensation was $2,266,000.

We had established a grantor trust that provided for assets to fund Mr. Perdue’ s SERP to

be placed in the trust upon a change-in-control (as defined in the grantor trust) of Dollar General.

The trust’ s assets were subject to the claims of our creditors. The trust also provided for a

distribution to Mr. Perdue to pay certain taxes in the event he was taxed in connection with the

funding of the trust and to apply interest at the rate of 6% per annum in the event payment was

delayed due to Section 409A of the Code. As a result of the Merger, and since the payment was

determined to be subject to Section 409A delay, a deposit of $6,208,966 was made to the trust

representing the lump sum and interest value of Mr. Perdue’ s benefit. This amount was paid to

Mr. Perdue on January 7, 2008.

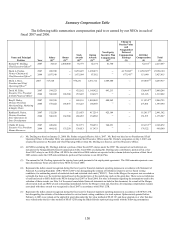

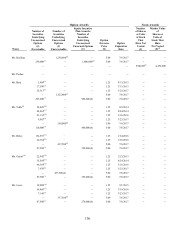

Nonqualified Deferred Compensation

Fiscal 2007

We offer a CDP/SERP Plan to certain key employees, including the NEOs. Mr. Perdue

was not eligible to participate in the SERP portion of the CDP/SERP Plan due to his participation

in his individualized SERP discussed under “Pension Benefits” above. Information regarding the

NEOs’ participation in the CDP/SERP Plan is included in the following table. The material terms

of the CDP/SERP Plan are described after the table. Please also see “Benefits and Perquisites”

in “Compensation Discussion and Analysis” above.