Dollar General 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183

|

|

78

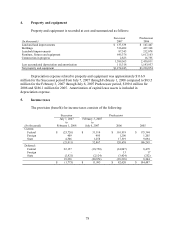

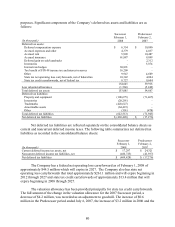

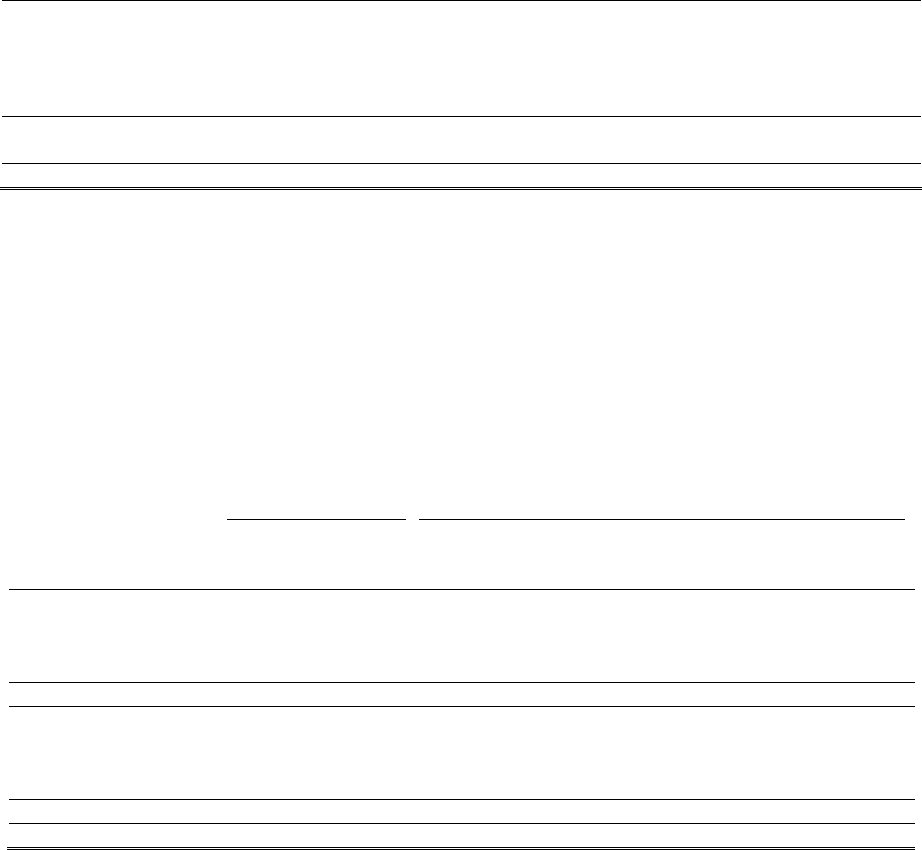

4. Property and equipment

Property and equipment is recorded at cost and summarized as follows:

(In thousands) Successor

2007

Predecessor

2006

Land and land improvements $ 137,539 $ 147,447

Buildings 516,482 437,368

Leasehold improvements 87,343 212,078

Furniture, fixtures and equipment 645,376 1,617,163

Construction in progress 2,823 16,755

1,389,563 2,430,811

Less accumulated depreciation and amortization 115,318 1,193,937

Net property and equipment $1,274,245 $1,236,874

Depreciation expense related to property and equipment was approximately $116.9

million for the Successor period from July 7, 2007 through February 1, 2008 compared to $83.5

million for the February 3, 2007 through July 6, 2007 Predecessor period, $199.6 million for

2006 and $186.1 million for 2005. Amortization of capital lease assets is included in

depreciation expense.

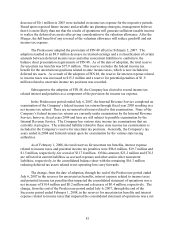

5. Income taxes

The provision (benefit) for income taxes consists of the following:

Successor Predecessor

(In thousands)

July 7, 2007

to

February 1, 2008

February 3, 2007

to

July 6, 2007 2006 2005

Current:

Federal $ (25,726) $ 31,114 $ 101,919 $ 175,344

Foreign 409 495 1,200 1,205

State 4,306 1,258 17,519 9,694

(21,011) 32,867 120,638 186,243

Deferred:

Federal 22,157 (18,750) (34,807) 8,479

Foreign - - 13 17

State (2,921) (2,124) (3,424) (252)

19,236 (20,874) (38,218) 8,244

$ (1,775) $ 11,993 $ 82,420 $ 194,487