Dollar General 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

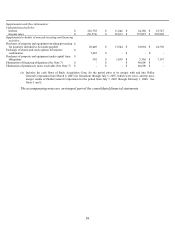

Generally, for store closures where a lease obligation still exists, the Company records

the estimated future liability associated with the rental obligation on the date the store is closed

in accordance with SFAS 146, “Accounting for Costs Associated with Exit or Disposal

Activities.” The estimated future liability associated with the rental obligation for certain store

closures associated with the Merger were based on EITF 95-3, “Recognition of Liabilities in

Connection with a Purchase Business Combination.” In the normal course of business, based on

an overall analysis of store performance and expected trends, management periodically evaluates

the need to close underperforming stores. Liabilities are established at the point of closure for the

present value of any remaining operating lease obligations, net of estimated sublease income,

and at the communication date for severance and other exit costs, as prescribed by SFAS 146.

Key assumptions in calculating the liability include the timeframe expected to terminate lease

agreements, estimates related to the sublease potential of closed locations, and estimation of

other related exit costs. Liabilities are reviewed periodically and adjusted when necessary. The

closed store liability balance at February 1, 2008 and February 2, 2007 was $20.2 million and

$5.4 million, respectively.

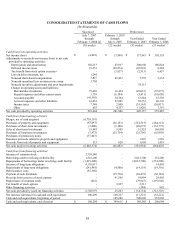

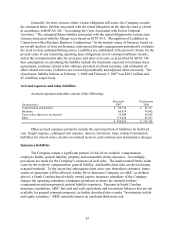

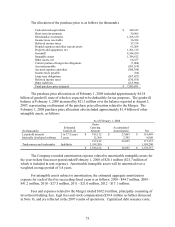

Accrued expenses and other liabilities

Accrued expenses and other consist of the following:

(In thousands) Successor

2007

Predecessor

2006

Compensation and benefits $ 60,720 $ 41,957

Insurance 64,418 76,062

Taxes (other than taxes on income) 55,990 50,502

Other 119,828 85,037

$ 300,956 $ 253,558

Other accrued expenses primarily include the current portion of liabilities for deferred

rent, freight expense, contingent rent expense, interest, electricity, lease contract termination

liabilities for closed stores, income tax related reserves, and common area maintenance charges.

Insurance liabilities

The Company retains a significant portion of risk for its workers’ compensation,

employee health, general liability, property and automobile claim exposures. Accordingly,

provisions are made for the Company’ s estimates of such risks. The undiscounted future claim

costs for the workers’ compensation, general liability, and health claim risks are derived using

actuarial methods. To the extent that subsequent claim costs vary from those estimates, future

results of operations will be affected. Ashley River Insurance Company (or ARIC, as defined

above), a South Carolina-based wholly owned captive insurance subsidiary of the Company,

charges the operating subsidiary companies premiums to insure the retained workers’

compensation and non-property general liability exposures. Pursuant to South Carolina

insurance regulations, ARIC has cash and cash equivalents and investment balances that are not

available for general corporate purposes, as further described above under “Investments in debt

and equity securities.” ARIC currently insures no unrelated third-party risk.