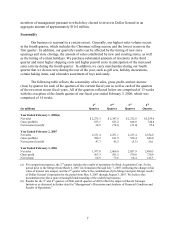

Dollar General 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

of war, employee and certain other crime and some natural disasters. If we incur these losses, our

business could suffer. Certain material events may result in sizable losses for the insurance

industry and adversely impact the availability of adequate insurance coverage or result in

excessive premium increases. To offset negative insurance market trends, we may elect to self-

insure, accept higher deductibles or reduce the amount of coverage in response to these market

changes. In addition, we self-insure a significant portion of expected losses under our workers’

compensation, automobile liability, general liability and group health insurance programs.

Unanticipated changes in any applicable actuarial assumptions and management estimates

underlying our recorded liabilities for these losses, including expected increases in medical and

indemnity costs, could result in materially different amounts of expense than expected under

these programs, which could have a material adverse effect on our financial condition and results

of operations. Although we continue to maintain property insurance for catastrophic events, we

are effectively self-insured for losses up to the amount of our deductibles. If we experience a

greater number of these losses than we anticipate, our financial performance could be adversely

affected.

Litigation may adversely affect our business, financial condition and results of operations.

Our business is subject to the risk of litigation by employees, consumers, suppliers,

shareholders, government agencies, or others through private actions, class actions,

administrative proceedings, regulatory actions or other litigation. The outcome of litigation,

particularly class action lawsuits and regulatory actions, is difficult to assess or quantify.

Plaintiffs in these types of lawsuits may seek recovery of very large or indeterminate amounts,

and the magnitude of the potential loss relating to these lawsuits may remain unknown for

substantial periods of time. In addition, certain of these lawsuits, if decided adversely to us or

settled by us, may result in liability material to our financial statements as a whole or may

negatively affect our operating results if changes to our business operation are required. The cost

to defend future litigation may be significant. There also may be adverse publicity associated

with litigation that could negatively affect customer perception of our business, regardless of

whether the allegations are valid or whether we are ultimately found liable. As a result, litigation

may adversely affect our business, financial condition and results of operations. See Part I, Item

3 “Legal Proceedings” for further details regarding certain of these pending matters.

In addition, from time to time, third parties may claim that our trademarks or product

offerings infringe upon their proprietary rights. Any such claim, whether or not it has merit,

could be time-consuming and distracting for executive management, result in costly litigation,

cause changes to our private label offerings or delays in introducing new private label offerings,

or require us to enter into royalty or licensing agreements. As a result, any such claim could have

a material adverse effect on our business, results of operations and financial condition.

The Investors control us and may have conflicts of interest with us now or in the future.

The Investors indirectly own, through their investment in Parent, a substantial portion of

our common stock. As a result, the Investors have control over our decisions to enter into any

corporate transaction and have the ability to prevent any transaction that requires the approval of

shareholders regardless of whether others believe that any such transactions are in our own best