Dollar General 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

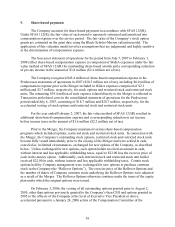

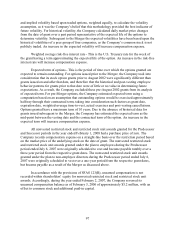

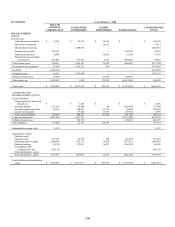

A summary of Time Options activity during the Successor period ended February 1, 2008

is as follows:

Options

Issued

Weighted Average

Exercise Price

Granted 9,945,000 $ 5.00

Exercised - -

Canceled (410,000) 5.00

Balance, February 1, 2008 9,535,000 $ 5.00

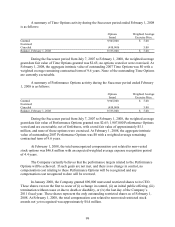

During the Successor period from July 7, 2007 to February 1, 2008, the weighted average

grant date fair value of Time Options granted was $2.65; no options vested or were exercised. At

February 1, 2008, the aggregate intrinsic value of outstanding 2007 Time Options was $0 with a

weighted average remaining contractual term of 9.6 years. None of the outstanding Time Options

are currently exercisable.

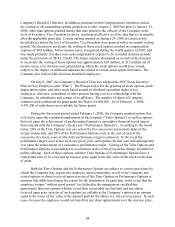

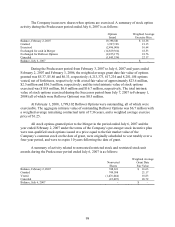

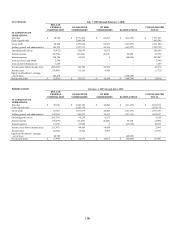

A summary of Performance Options activity during the Successor period ended February

1, 2008 is as follows:

Options

Issued

Weighted Average

Exercise Price

Granted 9,945,000 $ 5.00

Exercised - -

Canceled (410,000) 5.00

Balance, February 1, 2008 9,535,000 $ 5.00

During the Successor period from July 7, 2007 to February 1, 2008, the weighted average

grant date fair value of Performance Options granted was $2.65; 1,907,000 Performance Options

vested and are exercisable, net of forfeitures, with a total fair value of approximately $5.1

million, and none of those options were exercised. At February 1, 2008, the aggregate intrinsic

value of outstanding 2007 Performance Options was $0 with a weighted average remaining

contractual term of 9.6 years.

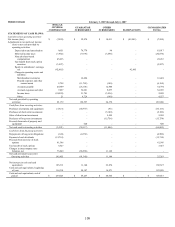

At February 1, 2008, the total unrecognized compensation cost related to non-vested

stock options was $46.8 million with an expected weighted average expense recognition period

of 4.4 years.

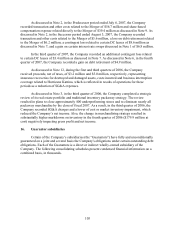

The Company currently believes that the performance targets related to the Performance

Options will be achieved. If such goals are not met, and there is no change in control, no

compensation cost relating to these Performance Options will be recognized and any

compensation cost recognized to date will be reversed.

In January 2008, the Company granted 890,000 nonvested restricted shares to its CEO.

These shares vest on the first to occur of (i) a change in control, (ii) an initial public offering, (iii)

termination without cause or due to death or disability, or (iv) the last day of the Company’ s

2011 fiscal year. These shares represent the only outstanding restricted shares as of February 1,

2008. At February 1, 2008, the total compensation cost related to nonvested restricted stock

awards not yet recognized was approximately $4.4 million.