Dollar General 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

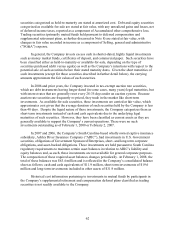

instrument positions taken by the Company are intended to be used to reduce risk by hedging an

underlying economic exposure.

The Company’ s derivative financial instruments, in the form of interest rate swaps, are

related to variable interest rate risk exposures associated with the Company’ s long-term debt and

were entered into in an attempt to manage that risk. The counterparties to the Company’ s

derivative agreements are all major international financial institutions. The Company continually

monitors its position and the credit ratings of its counterparties and does not anticipate

nonperformance by the counterparties. The Company does not offset fair value amounts of

derivatives and associated cash collateral.

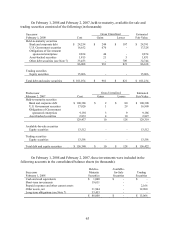

In April 2007, Buck entered into interest rate swaps, contingent upon the completion of

the Merger, on a portion of the loans anticipated to result from the Merger. The interest rate

swaps result in the Company paying a fixed rate of 7.683% on a notional amount of $2.0 billion

as of July 31, 2007, with the notional amount of these swaps amortizing on a quarterly basis

through July 31, 2012. Such notional amount was $1.6 billion as of February 1, 2008. The swaps

were designated as cash flow hedges on October 12, 2007. For the period prior to hedge

designation, an unrealized loss of $3.7 million for the Successor period has been recognized in

Loss on interest rate swaps in the consolidated statements of operations, reflecting the changes in

fair value of the swaps prior to their designation as qualifying cash flow hedging relationships,

which were offset by earnings under the contractual provisions of the swaps of $1.7 million

during the same time period.

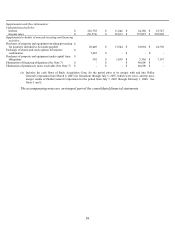

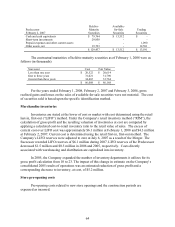

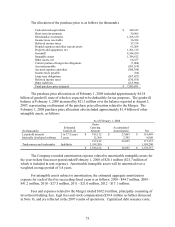

As of February 1, 2008, the fair value of the interest rate swaps of ($82.3) million was

recorded in non-current Other liabilities on the consolidated balance sheet. From the date the

swaps were designated as hedges, the effective portion of the change in fair value of the swaps of

($78.6) million was recorded in Other comprehensive income, a separate component of equity,

offset by related income taxes of $29.5 million. The Company also recorded expense related to

hedge ineffectiveness of $0.4 million during the Successor period ended February 1, 2008.

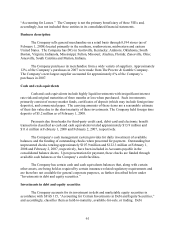

Share-based payments

Effective February 4, 2006, the Company adopted SFAS 123 (Revised 2004) “Share

Based Payment” (“SFAS 123(R)”) and began recognizing compensation expense for share-based

compensation based on the fair value of the awards on the grant date. SFAS 123(R) requires

share-based compensation expense recognized since February 4, 2006 to be based on: (a) grant

date fair value estimated in accordance with the original provisions of SFAS 123, “Accounting

for Stock-Based Compensation,” for unvested options granted prior to the adoption date and (b)

grant date fair value estimated in accordance with the provisions of SFAS 123(R) for unvested

options granted after the adoption date. The Company adopted SFAS 123(R) under the modified-

prospective-transition method and, therefore, results from prior periods have not been restated.

Prior to February 4, 2006, the Company accounted for share-based payments using the

intrinsic-value-based recognition method prescribed by Accounting Principles Board Opinion 25,

“Accounting for Stock Issued to Employees” (“APB 25”), and provided pro forma disclosures as

permitted under SFAS 123. Because options were granted at an exercise price equal to the

market price of the underlying common stock on the grant date, compensation cost related to