Dollar General 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies

Basis of presentation

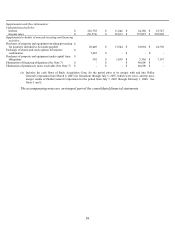

These notes contain references to the years 2008, 2007, 2006, and 2005, which represent

fiscal years ending or ended January 30, 2009, February 1, 2008, February 2, 2007, and February

3, 2006, respectively. Fiscal 2008 will be, and each of fiscal years 2007 and 2006 were, a 52-

week accounting period while fiscal 2005 was a 53-week accounting period. The Company’ s

fiscal year ends on the Friday closest to January 31. The consolidated financial statements

include all subsidiaries of the Company, except for its not-for-profit subsidiary the assets and

revenues of which are not material. Intercompany transactions have been eliminated.

Dollar General Corporation (the “Company”) was acquired on July 6, 2007 through a

Merger (as defined and discussed in greater detail in Note 2 below) accounted for as a reverse

acquisition. Although the Company continued as the same legal entity after the Merger, the

accompanying consolidated financial statements are presented for the “Predecessor” and

“Successor” relating to the periods preceding and succeeding the Merger, respectively. As a

result of the Company applying purchase accounting and a new basis of accounting beginning on

July 7, 2007, the financial reporting periods presented are as follows:

• The 2007 periods presented include the 22-week Predecessor period of the Company

from February 3, 2007 to July 6, 2007 and the 30-week Successor period, reflecting

the merger of the Company and Buck Acquisition Corp. (“Buck”) from July 7, 2007

to February 1, 2008.

• Buck’ s results of operations for the period from March 6, 2007 to July 6, 2007 (prior

to the Merger on July 6, 2007) are also included in the consolidated financial

statements for the Successor period described above as a result of certain derivative

financial instruments entered into by Buck prior to the Merger, as further described

below. Other than these financial instruments, Buck had no assets, liabilities, or

operations prior to the Merger.

• The 2006 and 2005 periods presented reflect the Predecessor. The consolidated

financial statements for the Predecessor periods have been prepared using the

Company’ s historical basis of accounting. As a result of purchase accounting, the

pre-Merger and post-Merger consolidated financial statements are not comparable.

The Company leases three of its distribution centers (“DCs”) from lessors, which meet

the definition of a Variable Interest Entity (“VIE”) as described by Financial Accounting

Standards Board (“FASB”) Interpretation 46, “Consolidation of Variable Interest Entities” (“FIN

46”), as revised. One of these DCs has been recorded as a financing obligation whereby the

property and equipment, along with the related lease obligations, are reflected in the consolidated

balance sheets. The land and buildings of the other two DCs have been recorded as operating

leases in accordance with Statement of Financial Accounting Standards (“SFAS”) 13,