Dollar General 2007 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

159

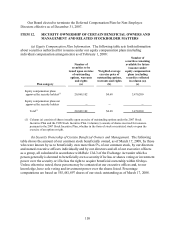

Name of Beneficial Owner

Amount and Nature of

Beneficial Ownership

Percent of

Class

KKR(1)(2) 288,399,897 51.92%

The Goldman Sachs Group, Inc.(2)(3) 119,999,943 21.60%

Citigroup Capital Partners(2)(4) 39,999,981 7.20%

CPP Investment Board (USRE II) Inc.(2)(5) 40,000,000 7.20%

Wellington Management Company, LLP(2)(6) 40,000,000 7.20%

Michael M. Calbert(7) 288,399,897 51.92%

Raj Agrawal(7) 288,399,897 51.92%

Adrian Jones(8) 119,999,943 21.60%

Dean B. Nelson -- --

Richard W. Dreiling(9)(10) 1,140,000 *

David L. Beré(10) 687,177 *

David A. Perdue -- --

David M. Tehle(10) 318,001 *

Beryl J. Buley(10) 288,797 *

Kathleen R. Guion(10) 250,698 *

Challis M. Lowe(10) 199,255 *

All current directors and executive officers as a group

(13 persons)(7)(8)(10)

411,722,995 73.86%

* Denotes less than 1% of class.

(1) Includes the following number of shares held by the following entities: KKR 2006 Fund L.P.

(203,464,902.69); KKR PEI Investments, L.P. (49,999,976.09); KKR Partners III, L.P. (4,724,997.74)

and Buck Holdings Co-Invest, LP (30,210,020). Buck Holdings Co-Invest GP, LLC, which is

controlled by KKR 2006 GP LLC, is the general partner of Buck Holdings Co-Invest, LP, and has the

right to manage the affairs of such entity, and thus is deemed to be the beneficial owner of the

securities owned by such entity. However, it does not have any economic or other dispositive rights

with respect to such securities and thus disclaims beneficial ownership with respect thereto. The

address of KKR is c/o Kohlberg Kravis Roberts & Co. L.P., 2800 Sand Hill Road, Suite 200, Menlo

Park, CA 94025.

(2) Indirectly held through Buck Holdings, L.P.

(3) Includes the following number of shares held by the following entities: GS Capital Partners VI

Parallel, L.P. (12,194,145.412); GS Capital Partners VI GmbH & Co. KG (1,576,025.208); GS Capital

Partners VI Fund, L.P. (44,345,094.704); GS Capital Partners VI Offshore Fund, L.P.

(36,884,689.242); Goldman Sachs DGC Investors, L.P. (6,692,778.104) and Goldman Sachs DGC

Investors Offshore Holdings, L.P. (13,307,212.332) (collectively, the “GS Funds”); and GSUIG,

L.L.C. (4,999,997.608). Affiliates of The Goldman Sachs Group, Inc. are the general partner,

managing general partner or investment manager of each of the GS Funds, and each of the GS Funds

shares voting and investment power with certain of its respective affiliates. Each of the GS Funds is

affiliated with or managed by Goldman, Sachs & Co., a wholly owned subsidiary of The Goldman

Sachs Group, Inc. Each of The Goldman Sachs Group, Inc. and Goldman, Sachs & Co. disclaims

beneficial ownership of the shares owned by each of the GS Funds, except to the extent of their

pecuniary interest therein, if any. The address of each of the GS Funds and GSUIG, L.L.C. is

c/o Goldman, Sachs & Co., 85 Broad Street 10th floor, New York, New York 10004.

(4) Includes the following number of shares held by the following entities: Citigroup Capital Partners II

Employee Master Fund, L.P. (8,598,705.956); Citigroup Capital Partners II 2007 Citigroup

Investment, L.P. (7,655,121.066); Citigroup Capital Partners II Onshore, L.P. (3,881,957.266);

Citigroup Capital Partners II Cayman Holdings, L.P. (4,864,203.756) and CPE Co-Investment (Dollar

General) LLC (14,999,992.826). The address of Citigroup Capital Partners is c/o Citigroup Inc.,

388 Greenwich Street, 32nd Floor, New York, New York 10013.

(5) The Address of CPP Investment Board (USRE II) Inc. is c/o Canada Pension Plan Investment Board,

One Queen Street East, Suite 2600, Toronto, ON M5C 2W5, Canada.