Dollar General 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

leased properties are amortized over the shorter of the life of the applicable lease term or the

estimated useful life of the asset.

For store closures (excluding those associated with a business combination) where a lease

obligation still exists, we record the estimated future liability associated with the rental

obligation on the date the store is closed in accordance with SFAS 146, “Accounting for Costs

Associated with Exit or Disposal Activities.” Based on an overall analysis of store performance

and expected trends, management periodically evaluates the need to close underperforming

stores. Liabilities are established at the point of closure for the present value of any remaining

operating lease obligations, net of estimated sublease income, and at the communication date for

severance and other exit costs, as prescribed by SFAS 146. Key assumptions in calculating the

liability include the timeframe expected to terminate lease agreements, estimates related to the

sublease potential of closed locations, and estimation of other related exit costs. If actual timing

and potential termination costs or realization of sublease income differ from our estimates, the

resulting liabilities could vary from recorded amounts. These liabilities are reviewed periodically

and adjusted when necessary.

Share-Based Payments. Our share-based stock option awards are valued on an individual

grant basis using the Black-Scholes-Merton closed form option pricing model. The application of

this valuation model involves assumptions that are judgmental and highly sensitive in the

valuation of stock options, which affects compensation expense related to these options. These

assumptions include the term that the options are expected to be outstanding, an estimate of the

volatility of our stock price (which is based on a peer group of publicly traded companies),

applicable interest rates and the dividend yield of our stock. Other factors involving judgments

that affect the expensing of share-based payments include estimated forfeiture rates of share-

based awards. If our estimates differ materially from actual experience, we may be required to

record additional expense or reductions of expense, which could be material to our future

financial results.

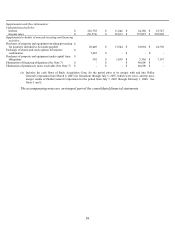

Adoption of Accounting Standard

We adopted the provisions of FIN 48 effective February 3, 2007. The adoption resulted

in an $8.9 million decrease in retained earnings and a reclassification of certain amounts between

deferred income taxes and other noncurrent liabilities to conform to the balance sheet

presentation requirements of FIN 48. As of the date of adoption, the total reserve for uncertain

tax benefits was $77.9 million. This reserve excludes the federal income tax benefit for the

uncertain tax positions related to state income taxes which is now included in deferred tax assets.

As a result of the adoption of FIN 48, the reserve for interest expense related to income taxes

was increased to $15.3 million and a reserve for potential penalties of $1.9 million related to

uncertain income tax positions was recorded. As of the date of adoption, approximately $27.1

million of the reserve for uncertain tax positions would impact our effective income tax rate if

we were to recognize the tax benefit for these positions. After the Merger and the related

application of purchase accounting, no portion of the reserve for uncertain tax positions that

existed as of the date of adoption would impact our effective tax rate but would, if subsequently

recognized, reduce the amount of goodwill recorded in relation to the Merger.