Dollar General 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

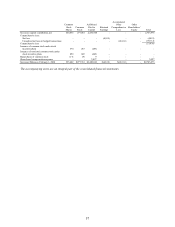

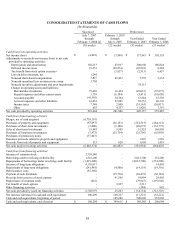

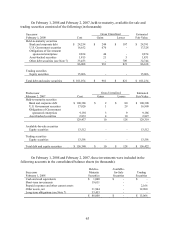

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands except per share amounts)

Common

Stock

Shares

Common

Stock

Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Loss

Other

Shareholders’

Equity Total

Predecessor Balances, January 28, 2005 328,172 $ 164,086 $ 421,600 $1,102,457 $ (973) $ (2,705) $1,684,465

Comprehensive income:

Net income - - - 350,155 - - 350,155

Reclassification of net loss on derivatives - - - - 179 - 179

Comprehensive income 350,334

Cash dividends, $0.175 per common share - - - (56,183) - - (56,183)

Issuance of common stock under stock

incentive plans 2,249 1,125 28,280 - - - 29,405

Tax benefit from stock option exercises - - 6,457 - - - 6,457

Repurchases of common stock (14,977) (7,489) - (290,113) - - (297,602)

Sales of common stock by employee deferred

compensation trust, net (42 shares) - - 95 - - 788 883

Issuance of restricted stock and restricted stock

units, net 249 125 5,151 - - (5,276) -

Amortization of unearned compensation on

restricted stock and restricted stock units - - - - - 2,394 2,394

Acceleration of vesting of stock options (see

Note 9) - - 938 - - - 938

Other equity transactions (14) (7) (138) (151) - - (296)

Predecessor Balances, February 3, 2006 315,679 $ 157,840 $ 462,383 $1,106,165 $ (794) $ (4,799) $1,720,795

Comprehensive income:

Net income - - - 137,943 - - 137,943

Reclassification of net loss on derivatives - - - - 188 - 188

Comprehensive income 138,131

Cash dividends, $0.20 per common share - - - (62,472) - - (62,472)

Issuance of common stock under stock

incentive plans 1,573 786 19,108 - - - 19,894

Tax benefit from share-based payments - - 2,513 - - - 2,513

Repurchases of common stock (4,483) (2,242) - (77,705) - - (79,947)

Purchases of common stock by employee

deferred compensation trust, net (3 shares) - - (2) - - 40 38

Reversal of unearned compensation upon

adoption of SFAS 123(R) (see Note 9) (364) (182) (4,997) - - 5,179 -

Share-based compensation expense - - 7,578 - - - 7,578

Vesting of restricted stock and restricted stock

units 149 75 (75) - - - -

Transition adjustment upon adoption of

SFAS 158 - - - - (381) - (381)

Other equity transactions (118) (59) (363) 20 - - (402)

Predecessor Balances, February 2, 2007 312,436 $ 156,218 $ 486,145 $1,103,951 $ (987) $ 420 $1,745,747

Adoption of FIN 48 - - - (8,917) - - (8,917)

Predecessor Balances as adjusted, February 2,

2007 312,436 156,218 486,145 1,095,034 (987) 420 1,736,830

Comprehensive income:

Net loss - - - (7,998) - - (7,998)

Reclassification of net loss on derivatives - - - - 76 - 76

Comprehensive loss - - - - - - (7,922)

Cash dividends, $0.05 per common share - - - (15,710) - - (15,710)

Issuance of common stock under stock

incentive plans 2,496 1,248 40,294 - - - 41,542

Tax benefit from stock option exercises - - 3,927 - - - 3,927

Share-based compensation expense - - 45,458 - - - 45,458

Vesting of restricted stock and restricted stock

units 126 63 (63) - - - -

Other equity transactions (28) (13) (580) (48) - 7 (634)

Elimination of Predecessor equity in

connection with Merger (see Notes 1 and 2) (315,030) (157,516) (575,181) (1,071,278) 911 (427) (1,803,491)

Predecessor Balances subsequent to Merger $ - $ - $ - $ - $ - $ - $ -