Dollar General 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84

property and any borrowings in excess of the then current borrowing base. Beginning September

30, 2009, the Company is required to repay installments on the loans under the term loan credit

facility in equal quarterly principal amounts in an aggregate amount per annum equal to 1% of

the total funded principal amount at July 6, 2007, with the balance payable on July 6, 2014.

All obligations under the New Credit Facilities are unconditionally guaranteed by

substantially all of the Company’ s existing and future domestic subsidiaries (excluding certain

immaterial subsidiaries and certain subsidiaries designated by the Company under the New

Credit Facilities as “unrestricted subsidiaries”).

All obligations and guarantees of those obligations under the term loan credit facility are

secured by, subject to certain exceptions, a second-priority security interest in all existing and

after-acquired inventory and accounts receivable; a first priority security interest in substantially

all of the Company’ s and the guarantors’ tangible and intangible assets (other than the inventory

and accounts receivable collateral just described); and first-priority pledge of the capital stock

held by the Company. All obligations under the asset-based revolving credit facility are secured

by all existing and after-acquire inventory and accounts receivable, subject to certain exceptions.

The New Credit Facilities contain certain covenants, including, among other things,

covenants that limit the Company’ s ability to incur additional indebtedness, sell assets, incur

additional liens, pay dividends, make investments or acquisitions, or repay certain indebtedness.

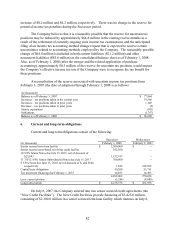

As of February 1, 2008, the Company had $102.5 million in borrowings, $28.8 million of

commercial letters of credit, and $69.2 million of standby letters of credit outstanding under the

asset-based revolving credit facility, with excess availability under that facility of $769.2 million.

As of February 1, 2008, the Company had $2,300.0 million outstanding under the term loan

facility.

In addition, on July 6, 2007, in conjunction with the Merger, the Company issued

$1,175.0 million aggregate principal amount of 10.625% senior notes due 2015 (the “senior

notes”) which were issued net of a discount of $23.2 million and which mature on July 15, 2015

pursuant to an indenture, dated as of July 6, 2007 (the “senior indenture”), and $725 million

aggregate principal amount of 11.875%/12.625% senior subordinated toggle notes due 2017 (the

“senior subordinated notes”), which mature on July 15, 2017, pursuant to an indenture, dated as

of July 6, 2007 (the “senior subordinated indenture”). The senior notes and the senior

subordinated notes are collectively referred to herein as the “notes”. The senior indenture and

the senior subordinated indenture are collectively referred to herein as the “indentures”.

Interest on the notes is payable on January 15 and July 15 of each year, commencing on

January 15, 2008. Interest on the senior notes will be payable in cash. Cash interested on the

senior subordinated notes will accrue at a rate of 11.875% per annum and PIK interest (as that

term is defined below) will accrue at a rate of 12.625% per annum. The initial interest payment

on the senior subordinated notes was paid in cash. For certain subsequent interest periods, the

Company may elect to pay interest on the senior subordinated notes by increasing the principal

amount of the senior subordinated notes or issuing new senior subordinated notes (“PIK

interest”).