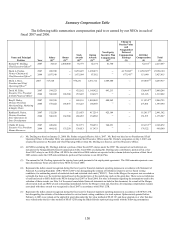

Dollar General 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.120

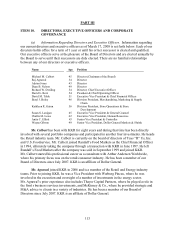

Gap, Federated Department Stores, Blockbuster, The Pantry, Ross Stores, and SuperValue Inc.

Hewitt was also asked to provide proxy statement information for certain other significantly

larger retail companies (Wal-Mart, Target, Walgreen’ s and CVS) to be used as additional

reference points in assessing the appropriateness of our NEOs’ compensation levels.

The Committee believed that the median of the competitive market generally was the

appropriate target for an NEO’ s total compensation, although the target for each compensation

component relative to the competitive market varied.

Elements of 2007 NEO Compensation

We provide compensation in the form of base salary, short-term incentives, long-term

incentives, benefits and perquisites. As discussed in more detail below, the Compensation

Committee believed that each of these elements was a necessary component of an NEO’ s

compensation package and was consistent with compensation programs at competing companies.

Prior to the Merger, the Committee reviewed base salary, short-term incentives, and long-term

incentives at least annually and other elements periodically when material changes were

considered.

Base Salary. Base salary generally promotes the recruiting and retention functions of

our compensation principles by reflecting the salaries for comparable positions in the

competitive marketplace. The Committee believed that we would be unable to attract or retain

quality NEOs in the absence of competitive base salary levels. For this reason, base salary

constitutes a significant portion of an NEO’ s total compensation. Base salary also furthers our

pay for performance role of our philosophy because, as a threshold matter, an NEO is not eligible

for a salary increase unless he or she achieves a satisfactory overall performance evaluation.

In determining each NEO’ s 2007 base salary, the Committee reviewed with Mr. Perdue

his evaluation of each NEO’ s individual performance. The evaluations included a review of

performance versus goals established earlier in 2006, except for Mr. Beré who did not have

established goals because he was hired near the end of fiscal 2006. Because the Committee

agreed with Mr. Perdue’ s conclusion that each NEO performed satisfactorily overall in 2006,

each NEO was eligible as a threshold matter for a salary increase.

The Committee also reviewed the benchmarking data provided by Hewitt, as described

above, and considered certain provisions in the Merger Agreement limiting the aggregate

employee base salary increase pool to no more than 3%. Because Hewitt’ s data showed that

existing base salaries with a 3% increase would continue to approximate the market median, the

Committee approved a 3% base salary increase for each NEO in 2007.

Subsequent to the fiscal 2007 year end but prior to the filing of this document, the new

Compensation Committee considered the 2008 base salary increases for each NEO. Mr.

Dreiling, with Mr. Beré’ s input, reviewed the 2007 individual performance of each NEO,

including a review of performance versus goals established earlier in 2007. Because Mr. Dreiling

determined that each NEO performed satisfactorily overall in 2007, as a threshold matter each

NEO was eligible for a salary increase.