Dollar General 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

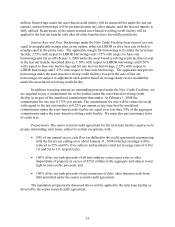

New Credit Facilities

Overview. On July 6, 2007, in connection with the Merger, we entered into two senior

secured credit agreements, each with Goldman Sachs Credit Partners L.P., Citicorp Global

Markets Inc., Lehman Brothers Inc. and Wachovia Capital Markets, LLC, each as joint lead

arranger and joint bookrunner. The CIT Group/Business Credit, Inc. is administrative agent

under the senior secured credit agreement for the asset-based revolving credit facility and

Citicorp North America, Inc. is administrative agent under the senior secured credit agreement

for the term loan facility.

The New Credit Facilities provide financing of $3.425 billion, consisting of:

• $2.3 billion in a senior secured term loan facility; and

• a senior secured asset-based revolving credit facility of up to $1.125 billion (of which

up to $350.0 million is available for letters of credit), subject to borrowing base

availability.

The term loan credit facility consists of two tranches, one of which is a “first-loss”

tranche, which, in certain circumstances, is subordinated in right of payment to the other tranche

of the term loan credit facility.

We are the borrower under the term loan credit facility, the primary borrower under the

asset-based credit facility and, in addition, certain subsidiaries of ours are designated as

borrowers under this facility. The asset-based credit facility includes borrowing capacity

available for letters of credit and for short-term borrowings referred to as swingline loans.

The New Credit Facilities provide that we have the right at any time to request up to

$325.0 million of incremental commitments under one or more incremental term loan facilities

and/or asset-based revolving credit facilities. The lenders under these facilities are not under any

obligation to provide any such incremental commitments and any such addition of or increase in

commitments will be subject to our not exceeding certain senior secured leverage ratios and

certain other customary conditions precedent. Our ability to obtain extensions of credit under

these incremental commitments will also be subject to the same conditions as extensions of

credit under the New Credit Facilities.

The amount from time to time available under the senior secured asset-based credit

facility (including in respect of letters of credit) shall not exceed the sum of the tranche A

borrowing base and the tranche A-1 borrowing base. The tranche A borrowing base equals the

sum of (i) 85% of the net orderly liquidation value of all our eligible inventory and that of each

guarantor thereunder and (ii) 90% of all our accounts receivable and credit/debit card receivables

and that of each guarantor thereunder, in each case, subject to a reserve equal to the principal

amount of the 2010 Notes that remain outstanding at any time and other customary reserves and

eligibility criteria. An additional 10% to 12% of the net orderly liquidation value of all our

eligible inventory and that of each guarantor thereunder is made available to us in the form of a

“last out” tranche in respect of which we may borrow up to a maximum amount of $125.0