Dollar General 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

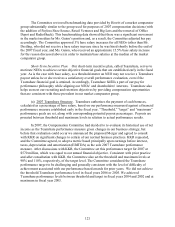

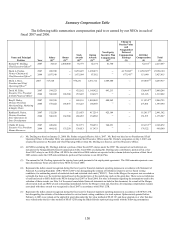

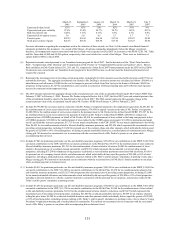

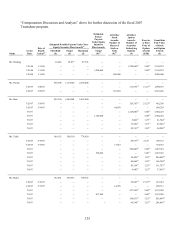

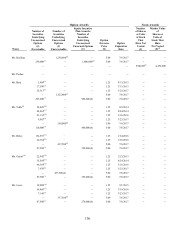

Summary Compensation Table

The following table summarizes compensation paid to or earned by our NEOs in each of

fiscal 2007 and 2006.

Name and Principal

Position Year

Salary

($)(2)

Bonus

($)(3)

Stock

Awards

($)(4)

Option

Awards

($)(5)

Non-Equity

Incentive Plan

Compensation

($)(6)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

Richard W. Dreiling,

Chief Executive Officer(1) 2007 34,615 2,000,000 36,777 42,174 41,760 -- 62,141(7) 2,217,467

David A. Perdue,

Former Chairman &

Chief Executive Officer(1)

2007

2006

488,390

1,037,540

--

--

8,259,225

1,472,904

1,690,873

87,582

--

--

4,179,884(8)

677,541(8)

11,238,529(9)

151,448

25,856,901

3,427,015

David L. Beré,

President and Chief

Operating Officer(1)

2007 717,528 -- 974,231 1,381,712 1,009,400 -- 187,046(10) 4,269,917

David M. Tehle,

Executive Vice President

& Chief Financial Officer

2007

2006

594,523

580,022

--

188,500

632,162

235,247

1,149,922

194,127

493,213

--

--

--

130,464(11)

121,126

3,000,284

1,319,022

Beryl J. Buley,

Division President,

Merchandising, Marketing

& Supply Chain

2007

2006

589,398

575,022

--

186,875

690,116

183,223

1,065,045

180,669

488,962

--

--

--

111,234(12)

273,801

2,944,755

1,399,590

Kathleen R. Guion,

Division President,

Store Operations &

Store Development

2007

2006

512,520

500,019

--

162,500

521,453

206,455

917,214

154,982

425,184

--

--

--

115,011(13)

151,971

2,491,382

1,175,927

Challis M. Lowe,

Executive Vice President,

Human Resources

2007

2006

420,266

404,182

--

133,250

512,771

130,813

768,251

117,933

348,651

--

--

--

118,133(14)

174,322

2,168,072

960,500

(1) Mr. Dreiling was hired on January 21, 2008. Mr. Perdue resigned effective July 6, 2007. Mr. Beré was hired as our President and Chief

Operating Officer in December 2006, was appointed interim Chief Executive Officer upon Mr. Perdue’ s resignation on July 6, 2007, and

resumed his position as President and Chief Operating Officer when Mr. Dreiling was hired as our Chief Executive Officer.

(2) All NEOs (excluding Mr. Dreiling) deferred a portion of their fiscal 2007 salaries under the CDP. The amounts of such deferrals are

included in the Nonqualified Deferred Compensation Table. Each NEO (excluding Mr. Dreiling) also contributed a portion of his or her

fiscal 2007 salary to our 401(k) Plan. All NEOs for which fiscal 2006 salaries are reported in this column deferred a portion of their fiscal

2006 salaries under the CDP and contributed a portion of their salaries to our 401(k) Plan.

(3) The amount for Mr. Dreiling represents the signing bonus paid pursuant to his employment agreement. The 2006 amounts represent a one-

time discretionary bonus awarded to these NEOs for fiscal 2006.

(4) Represents the dollar amount recognized during the fiscal year for financial statement reporting purposes in accordance with Statement of

Financial Accounting Standards 123R (“SFAS 123R”), but disregarding the estimate of forfeitures related to service-based vesting

conditions, for outstanding awards of restricted stock and restricted stock units (“RSUs”). Prior to the Merger, the expense was recorded on

a straight-line basis over the restriction period based on the market price of the underlying stock on the grant date. There were no forfeitures

of restricted stock or RSUs held by the NEOs during fiscal 2007 or fiscal 2006. For more information regarding the assumptions used in the

valuation of these awards, see Note 9 of the annual consolidated financial statements included in this document. As a result of the Merger,

all restricted stock and RSU awards outstanding immediately before the Merger vested and, therefore, all remaining compensation expense

associated with those awards was recognized in fiscal 2007 in accordance with SFAS 123R.

(5) Represents the dollar amount recognized during the fiscal year for financial statement reporting purposes in accordance with SFAS 123R,

but disregarding the estimate of forfeitures related to service-based vesting conditions, for stock options. Option awards granted before

February 4, 2006 were valued on the applicable grant date under the fair value method of SFAS 123 and those granted on or after that date

were valued under the fair value method of SFAS 123R using the Black-Scholes option pricing model with the following assumptions: