Dollar General 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

Revenue and gain recognition

The Company recognizes retail sales in its stores at the time the customer takes

possession of merchandise. All sales are net of discounts and estimated returns and are presented

net of taxes assessed by governmental authorities that are imposed concurrent with those sales.

The liability for retail merchandise returns is based on the Company’ s prior experience. The

Company records gain contingencies when realized.

The Company began gift card sales in the third quarter of 2005. The Company

recognizes gift card sales revenue at the time of redemption. The liability for the gift cards is

established for the cash value at the time of purchase. The liability for outstanding gift cards was

approximately $1.2 million and $0.8 million at February 1, 2008 and February 2, 2007,

respectively, and is recorded in Accrued expenses and other. Through February 1, 2008, the

Company has not recorded any breakage income related to its gift card program. The Company

will continue to evaluate its current breakage policy as it continues to gain more sufficient

company-specific customer experience.

Advertising costs

Advertising costs are expensed upon performance, “first showing” or distribution, and are

reflected net of qualifying cooperative advertising funds provided by vendors in SG&A

expenses. Advertising costs were $23.6 million $17.3 million, $45.0 million and $15.1 million in

the 2007 Successor and Predecessor periods, 2006 and 2005, respectively. These costs primarily

include promotional circulars, targeted circulars supporting new stores, television and radio

advertising, in-store signage, and costs associated with the sponsorship of a National Association

for Stock Car Auto Racing team. Vendor funding for cooperative advertising offset reported

expenses by $6.6 million, $2.0 million, $7.9 million and $0.8 million in the 2007 Successor and

Predecessor periods, 2006 and 2005, respectively.

Capitalized interest

To assure that interest costs properly reflect only that portion relating to current

operations, interest on borrowed funds during the construction of property and equipment is

capitalized. Interest costs capitalized were approximately $2.9 million and $3.3 million in 2006

and 2005, respectively.

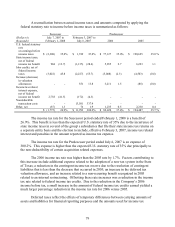

Income taxes

The Company reports income taxes in accordance with SFAS No. 109, “Accounting for

Income Taxes” (“SFAS 109”). Under SFAS 109, the asset and liability method is used for

computing the future income tax consequences of events that have been recognized in the

Company’ s consolidated financial statements or income tax returns. Deferred income tax

expense or benefit is the net change during the year in the Company’ s deferred income tax assets

and liabilities.