Dollar General 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

other companies. We believe that the presentation of EBITDA and Adjusted EBITDA is

appropriate to provide additional information about the calculation of this financial ratio in the

New Credit Facilities. Adjusted EBITDA is a material component of this ratio. Specifically, non-

compliance with the senior secured indebtedness ratio contained in our New Credit Facilities

could prohibit us from being able to incur additional secured indebtedness, other than the

additional funding provided for under the senior secured credit agreement and pursuant to

specified exceptions, to make investments, to incur liens and to make certain restricted payments.

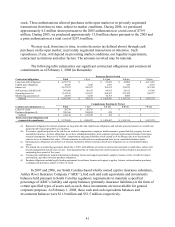

The calculation of Adjusted EBITDA under the New Credit Facilities is as follows:

(in millions)

Year Ended

February 1,

2008

Net income (loss) $ (12.8)

Add (subtract):

Interest income (8.8)

Interest expense 263.2

Depreciation and amortization 226.4

Income taxes 10.2

EBITDA 478.2

Adjustments:

Transaction and related costs 102.6

Loss on debt retirements, net 1.2

Loss on interest rate swaps 2.4

Contingent loss on distribution center leases 12.0

Impact of markdowns related to inventory

clearance activities, including LCM

adjustments, net of purchase accounting

adjustments 5.7

SG&A related to store closing and inventory

clearance activities 54.0

Operating losses (cash) of stores to be closed 10.5

Monitoring and consulting fees to affiliates 4.8

Stock option and restricted stock unit expense 6.5

Indirect merger-related costs 4.6

Other 1.0

Total Adjustments 205.3

Adjusted EBITDA $ 683.5

Other Considerations

Our inventory balance represented approximately 44% of our total assets exclusive of

goodwill and other intangible assets as of February 1, 2008. Our proficiency in managing our

inventory balances can have a significant impact on our cash flows from operations during a

given fiscal year. We have made more efficient inventory management a strategic priority, as

more fully discussed in the “Executive Overview” above.

During 2006 and 2005, the Predecessor’ s Board of Directors authorized the repurchase of

up to $500 million and 10 million shares, respectively, of the Predecessor’ s outstanding common