Dollar General 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

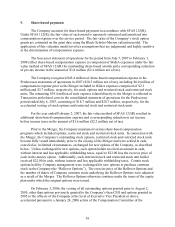

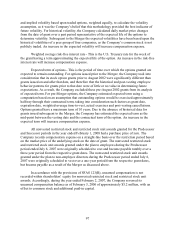

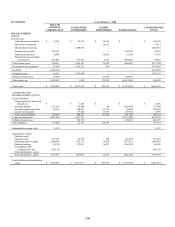

The Company issues new shares when options are exercised. A summary of stock option

activity during the Predecessor period ended July 6, 2007 is as follows:

Options

Issued

Weighted Average

Exercise Price

Balance, February 2, 2007 19,398,881 $ 18.38

Granted 1,997,198 21.15

Exercised (2,496,006) 16.64

Exchanged for cash in Merger (14,829,364) 18.53

Exchanged for Rollover Options (2,225,175) 18.76

Canceled (1,845,534) 22.17

Balance, July 6, 2007 - $ -

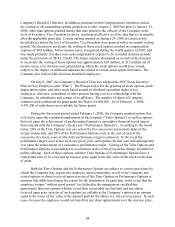

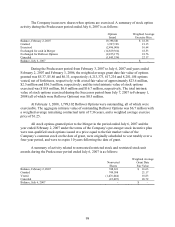

During the Predecessor period from February 3, 2007 to July 6, 2007 and years ended

February 2, 2007 and February 3, 2006, the weighted average grant date fair value of options

granted was $5.37, $5.86 and $6.33, respectively; 4,213,373, 617,234 and 8,281,184 options

vested, net of forfeitures, respectively; with a total fair value of approximately $23.6 million,

$2.5 million and $56.5 million, respectively; and the total intrinsic value of stock options

exercised was $10.8 million, $6.8 million and $16.7 million, respectively. The total intrinsic

value of stock options exercised during the Successor period from July 7, 2007 to February 1,

2008 (all of which were Rollover Options) was $0.5 million.

At February 1, 2008, 1,799,102 Rollover Options were outstanding, all of which were

exercisable. The aggregate intrinsic value of outstanding Rollover Options was $6.7 million with

a weighted average remaining contractual term of 7.36 years, and a weighted average exercise

price of $1.25.

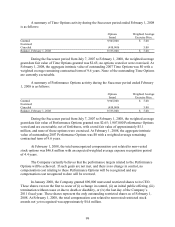

All stock options granted prior to the Merger in the period ended July 6, 2007 and the

year ended February 2, 2007 under the terms of the Company’ s pre-merger stock incentive plan

were non-qualified stock options issued at a price equal to the fair market value of the

Company’ s common stock on the date of grant, were originally scheduled to vest ratably over a

four-year period, and were to expire 10 years following the date of grant.

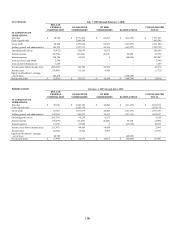

A summary of activity related to nonvested restricted stock and restricted stock unit

awards during the Predecessor period ended July 6, 2007 is as follows:

Nonvested

Shares

Weighted Average

Grant Date

Fair Value

Balance, February 2, 2007 748,631 $ 16.63

Granted 749,508 21.17

Vested (1,476,044) 18.83

Canceled (22,095) 20.72

Balance, July 6, 2007 - $ -