Dollar General 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.129

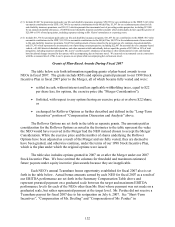

incentives under our 2007 Plan. Under the 2007 Plan, (1) all time-vested options will vest and

become immediately exercisable as to 100% of the shares of common stock subject to such

options immediately prior to a change-in-control and (2) all performance–vested options will

vest and become immediately exercisable as to 100% of the shares of common stock subject to

such options immediately prior to a change-in-control if, as a result of the change–in-control,

(x) investment funds affiliated with KKR realize a specified internal rate of return on 100% of

their aggregate investment, directly or indirectly, in our equity securities (the “Sponsor Shares”)

and (y) the investment funds affiliated with KKR earn a specified cash return on 100% of the

Sponsor Shares; provided, however, that in the event that a change-in-control occurs in which

more than 50% but less than 100% of our common stock or other voting securities or the

common stock or other voting securities of Buck Holdings, L.P. is sold or otherwise disposed of,

then the performance-vested options will become vested up to the same percentage of Sponsor

Shares on which investment funds affiliated with KKR achieve a specified internal rate of return

on their aggregate investment and earn a specified return on their Sponsor Shares. The Merger

constituted a change-in-control for purposes of our pre-Merger plans and arrangements.

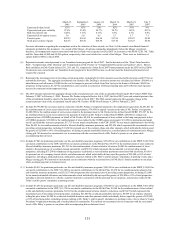

Deductibility of NEO Compensation

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to

public companies for compensation over $1 million paid in any fiscal year to an NEO that is not

performance-based compensation. We believe that compensation paid in 2007 associated with

stock options under our 1998 Stock Incentive Plan would generally be fully deductible for

federal income tax purposes. However, in certain situations (such as time-vested RSUs) the

Compensation Committee approved compensation that did not meet these requirements in order

to ensure competitive levels of total compensation for our NEOs. Because our common stock is

no longer publicly traded, the Board did not consider Section 162(m) with respect to 2007

compensation paid after the Merger.

Compensation Committee Report

Our Compensation Committee has reviewed and discussed with management the

Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K and, based on

such review and discussions, the Compensation Committee recommended to the Board that the

Compensation Discussion and Analysis be included in this document.

This report has been furnished by:

• Michael M. Calbert, Chairman

• Raj Agrawal

• Adrian Jones

The Compensation Committee Report is deemed furnished, not filed, in this document

and will not be deemed to be incorporated by reference into any filing under the Securities Act or

the Exchange Act as a result of furnishing the Compensation Committee Report in this manner.