Dollar General 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

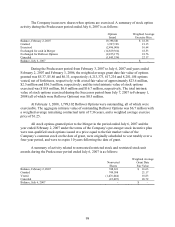

9. Share-based payments

The Company accounts for share-based payments in accordance with SFAS 123(R).

Under SFAS 123(R), the fair value of each award is separately estimated and amortized into

compensation expense over the service period. The fair value of the Company’ s stock option

grants are estimated on the grant date using the Black-Scholes-Merton valuation model. The

application of this valuation model involves assumptions that are judgmental and highly sensitive

in the determination of compensation expense.

The Successor statement of operations for the period from July 7, 2007 to February 1,

2008 reflect share-based compensation expense (a component of SG&A expenses) under the fair

value method of SFAS 123(R) for outstanding share-based awards and a corresponding reduction

of pre-tax income in the amount of $3.8 million ($2.4 million net of tax).

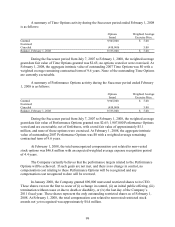

The Company recognized $45.4 million of share-based compensation expense in the

Predecessor statements of operations in 2007 ($28.5 million net of tax), including $6.0 million of

compensation expense prior to the Merger included in SG&A expenses comprised of $2.3

million and $3.7 million, respectively, for stock options and restricted stock and restricted stock

units. The remaining $39.4 million of such expense related directly to the Merger is reflected in

Transaction and related costs in the consolidated statement of operations for the Predecessor

period ended July 6, 2007, consisting of $18.7 million and $20.7 million, respectively, for the

accelerated vesting of stock options and restricted stock and restricted stock units.

For the year ended February 2, 2007, the fair value method of SFAS 123(R) resulted in

additional share-based compensation expense and a corresponding reduction in net income

before income taxes in the amount of $3.6 million ($2.2 million net of tax).

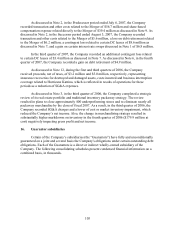

Prior to the Merger, the Company maintained various share-based compensation

programs which included options, restricted stock and restricted stock units. In connection with

the Merger, the Company’ s outstanding stock options, restricted stock and restricted stock units

became fully vested immediately prior to the closing of the Merger and were settled in cash,

canceled or, in limited circumstances, exchanged for new options of the Company, as described

below. Unless exchanged for new options, each option holder received an amount in cash,

without interest and less applicable withholding taxes, equal to $22.00 less the exercise price of

each in-the-money option. Additionally, each restricted stock and restricted stock unit holder

received $22.00 in cash, without interest and less applicable withholding taxes. Certain stock

options held by Company management were exchanged for new options to purchase common

stock in the Company (the “Rollover Options”). The exercise price of the Rollover Options and

the number of shares of Company common stock underlying the Rollover Options were adjusted

as a result of the Merger. The Rollover Options otherwise continue under the terms of the equity

plan under which the original options were issued.

On February 3, 2006, the vesting of all outstanding options granted prior to August 2,

2005, other than options previously granted to the Company’ s then CEO and options granted in

2005 to the officers of the Company at the level of Executive Vice President or above,

accelerated pursuant to a January 24, 2006 action of the Compensation Committee of the