Dollar General 2007 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.137

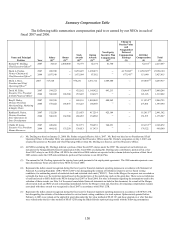

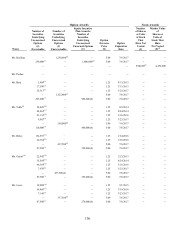

(1) Based on a per share fair market value of $5.00. Our Board of Directors determined in good faith that the per share market

value of our common stock on January 21, 2008 was $5.00.

(2) These options are scheduled to become exercisable ratably in installments of 20% on July 6, 2008, July 6, 2009, July 6,

2010, July 6, 2011 and July 6, 2012. In addition, these options are subject to certain accelerated vesting provisions as

described in “Potential Payments upon Termination or Change-in-Control” below.

(3) These options vested as of February 1, 2008.

(4) If we achieve specific EBITDA targets, these options are eligible to become exercisable in installments of 25% on January

30, 2009, January 29, 2010, January 28, 2011, and February 3, 2012. If an EBITDA target for a given fiscal year is not met,

these options may still vest on a “catch up” basis if, at the end of fiscal years 2008, 2009, 2010, 2011, or 2012, the

applicable cumulative EBITDA target is achieved. In addition, these options are subject to certain accelerated vesting

provisions as described in “Potential Payments upon Termination or Change-in-Control” below.

(5) These restricted shares are scheduled to vest upon the earliest to occur of: a change in control of the company, an initial

public offering of the company, Mr. Dreiling’ s termination without cause or due to death or disability, Mr. Dreiling’ s

resignation for good reason, or February 3, 2012.

(6) The options for which these Rollover Options were exchanged became exercisable on August 12, 2003.

(7) The options for which these Rollover Options were exchanged became exercisable on March 13, 2004.

(8) The options for which these Rollover Options were exchanged became exercisable on July 6, 2007.

(9) As a result of the Merger on July 6, 2007, Mr. Tehle forfeited 63,000 options having an exercise price higher than the

Merger Consideration.

(10) The options for which these Rollover Options were exchanged became exercisable in installments of 25% on August 9,

2005 and 75% on February 3, 2006.

(11) The options for which these Rollover Options were exchanged became exercisable in installments of 25% on August 24,

2005 and 75% on February 3, 2006.

(12) The options for which these Rollover Options were exchanged became exercisable in installments of 25% on March 16,

2007 and 75% on July 6, 2007.

(13) The options for which these Rollover Options were exchanged became exercisable in installments of 25% on January 24,

2007 and 75% on July 6, 2007.

(14) As a result of the Merger on July 6, 2007, Ms. Guion forfeited 50,300 options having an exercise price higher than the

Merger Consideration.

(15) The options for which these Rollover Options were exchanged became exercisable in installments of 25% on December 2,

2004 and December 2, 2005 and 50% on February 3, 2006.

(16) The options for which these Rollover Options were exchanged became exercisable in installments of 25% on September 1,

2006 and 75% on July 6, 2007.