Dollar General 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.94

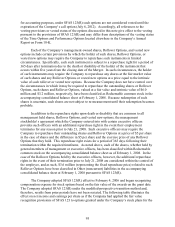

Company’ s Board of Directors. In addition, pursuant to that Compensation Committee action,

the vesting of all outstanding options granted on or after August 2, 2005 but prior to January 24,

2006, other than options granted during that time period to the officers of the Company at the

level of Executive Vice President or above, accelerated effective as of the date that is six months

after the applicable grant date. Certain options granted on January 24, 2006 to certain newly

hired officers below the level of Executive Vice President were granted with a six-month vesting

period. The decision to accelerate the vesting of these stock options resulted in compensation

expense of $0.9 million, before income taxes, recognized during the fourth quarter of 2005, and

was made primarily to reduce non-cash compensation expense to be recorded in future periods

under the provisions of SFAS 123(R). The future expense eliminated as a result of the decision

to accelerate the vesting of these options was approximately $28 million, or $17 million net of

income taxes, over the four-year period during which the stock options would have vested,

subject to the impact of additional adjustments related to certain stock option forfeitures. The

Company also believed this decision benefited employees.

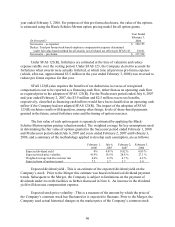

On July 6, 2007, the Company’ s Board of Directors adopted the 2007 Stock Incentive

Plan for Key Employees (the “Plan”). The Plan provides for the granting of stock options, stock

appreciation rights, and other stock-based awards or dividend equivalent rights to key

employees, directors, consultants or other persons having a service relationship with the

Company, its subsidiaries and certain of its affiliates. The number of shares of Company

common stock authorized for grant under the Plan is 24,000,000. As of February 1, 2008,

3,470,200 of such shares are available for future grants.

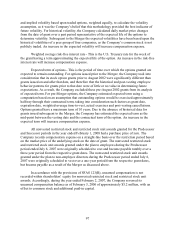

During the Successor period ended February 1, 2008, the Company granted options that

vest solely upon the continued employment of the recipient (“Time Options”) as well as options

that vest upon the achievement of predetermined annual or cumulative financial-based targets

that coincide with the Company’ s fiscal year (“Performance Options”). According to the award

terms, 20% of the Time Options vest on each of the five successive anniversary dates of the

merger transaction, and 20% of the Performance Options vests at the end of each of the

successive five fiscal years in which the performance target is achieved. In the event the

performance target is not achieved in any given year, such options for that year will subsequently

vest upon the achievement of a cumulative performance target. Vesting of the Time Options and

Performance Options is also subject to acceleration in the event of an earlier change in control or

public offering. Each of these options, whether Time Options or Performance Options have a

contractual term of 10 years and an exercise price equal to the fair value of the stock on the date

of grant.

Both the Time Options and the Performance Options are subject to various provisions by

which the Company may require the employee, upon termination, to sell to the Company any

vested options or shares received upon exercise of the Time Options or Performance Options at

amounts that differ based upon the reason for the termination. In particular, in the event that the

employee resigns “without good reason” (as defined in the management stockholders

agreement), then any options whether or not then exercisable are forfeited and any shares

received upon prior exercise of such options are callable at the Company’ s option at an amount

equal to the lesser of fair value or the amount paid for the shares (i.e. the exercise price). In such

cases, because the employee would not benefit in any share appreciation over the exercise price,