Dollar General 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.103

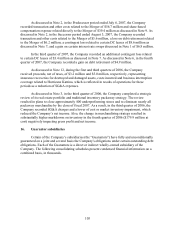

As discussed in Note 2, in the Predecessor period ended July 6, 2007, the Company

recorded transaction and other costs related to the Merger of $56.7 million and share-based

compensation expense related directly to the Merger of $39.4 million as discussed in Note 9. As

discussed in Note 2, in the Successor period ended August 3, 2007, the Company recorded

transaction and other costs related to the Merger of $5.6 million, a loss on debt retirement related

to the Merger of $6.2 million; a contingent loss related to certain DC leases of $8.6 million as

discussed in Note 7; and a gain on certain interest rate swaps discussed in Note 1 of $6.8 million.

In the third quarter of 2007, the Company recorded an additional contingent loss related

to certain DC leases of $3.4 million as discussed in Note 7. As discussed in Note 6, in the fourth

quarter of 2007, the Company recorded a gain on debt retirement of $4.9 million.

As discussed in Note 12, during the first and third quarters of 2006, the Company

received proceeds, net of taxes, of $3.2 million and $5.0 million, respectively, representing

insurance recoveries for destroyed and damaged assets, costs incurred and business interruption

coverage related to Hurricane Katrina, which is reflected in results of operations for these

periods as a reduction of SG&A expenses.

As discussed in Note 3, in the third quarter of 2006, the Company completed a strategic

review of its real estate portfolio and traditional inventory packaway strategy. The review

resulted in plans to close approximately 400 underperforming stores and to eliminate nearly all

packaway merchandise by the close of fiscal 2007. As a result, in the third quarter of 2006, the

Company recorded SG&A charges and a lower of cost or market inventory impairment, which

reduced the Company’ s net income. Also, the change in merchandising strategy resulted in

substantially higher markdowns on inventory in the fourth quarter of 2006 ($179.9 million at

cost) negatively impacting gross profit and net income.

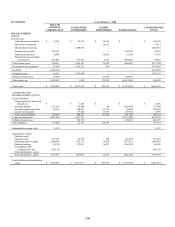

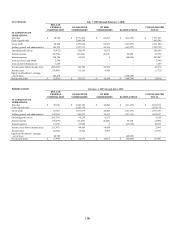

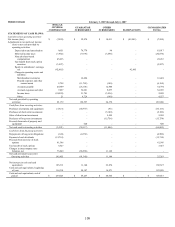

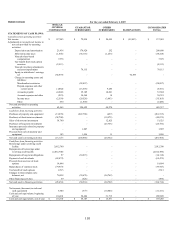

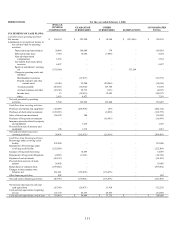

16. Guarantor subsidiaries

Certain of the Company’ s subsidiaries (the “Guarantors”) have fully and unconditionally

guaranteed on a joint and several basis the Company's obligations under certain outstanding debt

obligations. Each of the Guarantors is a direct or indirect wholly-owned subsidiary of the

Company. The following consolidating schedules present condensed financial information on a

combined basis, in thousands.