Dollar General 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.81

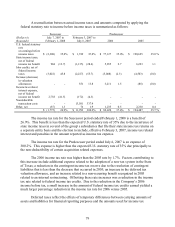

decrease of $0.1 million in 2005 were included in income tax expense for the respective periods.

Based upon expected future income and available tax planning strategies, management believes

that it is more likely than not that the results of operations will generate sufficient taxable income

to realize the deferred tax assets after giving consideration to the valuation allowance. After the

Merger, the full benefit of any reversal of the valuation allowance will reduce goodwill and not

income tax expense.

The Predecessor adopted the provisions of FIN 48 effective February 3, 2007. The

adoption resulted in an $8.9 million decrease in retained earnings and a reclassification of certain

amounts between deferred income taxes and other noncurrent liabilities to conform to the

balance sheet presentation requirements of FIN 48. As of the date of adoption, the total reserve

for uncertain tax benefits was $77.9 million. This reserve excludes the federal income tax

benefit for the uncertain tax positions related to state income taxes, which is now included in

deferred tax assets. As a result of the adoption of FIN 48, the reserve for interest expense related

to income taxes was increased to $15.3 million and a reserve for potential penalties of $1.9

million related to uncertain income tax positions was recorded.

Subsequent to the adoption of FIN 48, the Company has elected to record income tax

related interest and penalties as a component of the provision for income tax expense.

In the Predecessor period ended July 6, 2007, the Internal Revenue Service completed an

examination of the Company’ s federal income tax returns through fiscal year 2003 resulting in a

net income tax refund. There are no unresolved issues related to this examination. None of the

Company’ s federal income tax returns are currently under examination by the Internal Revenue

Service; however, fiscal years 2004 and later are still subject to possible examination by the

Internal Revenue Service. The Company has various state income tax examinations that are

currently in progress. The estimated liability related to these state income tax examinations is

included in the Company’ s reserve for uncertain tax positions. Generally, the Company’ s tax

years ended in 2004 and forward remain open for examination by the various state taxing

authorities.

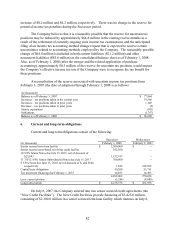

As of February 1, 2008, the total reserves for uncertain tax benefits, interest expense

related to income taxes and potential income tax penalties were $96.6 million, $19.7 million and

$1.5 million, respectively, for a total of $117.8 million. Of this amount, $23.2 million and $78.3

are reflected in current liabilities as accrued expenses and other and in other noncurrent

liabilities, respectively, in the consolidated balance sheet with the remaining $16.3 million

reducing deferred tax assets related to net operating loss carry forwards.

The change, from the date of adoption, through the end of the Predecessor period ended

July 6, 2007 in the reserves for uncertain tax benefits, interest expense related to income taxes

and potential income tax penalties that impacted the consolidated statement of operations was a

net increase of $10.4 million and $0.2 million and a decrease of $0.4 million, respectively. The

change, from the end of the Predecessor period ended July 6, 2007, through the end of the

Successor period ended February 1, 2008, in the reserves for uncertain tax benefits and interest

expense related to income taxes that impacted the consolidated statement of operations was a net