Dollar General 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138

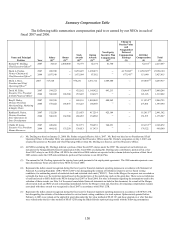

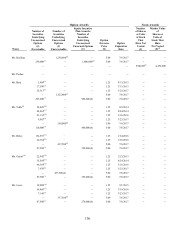

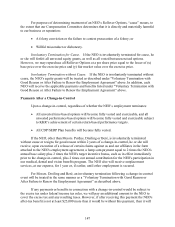

Option Exercises and Stock Vested During Fiscal 2007

The table below provides information regarding the value realized by our NEOs upon the

transfer for value of stock options and the vesting of stock awards during fiscal 2007.

Option Awards(1) Stock Awards

Name

Number of Shares

Acquired on

Exercise

(#)

Value Realized

on Exercise

($)

Number of Shares

Acquired on Vesting

(#)

Value Realized

on Vesting

($)

Mr. Dreiling -- -- -- --

Mr. Perdue 1,313,630 9,555,223 587,516 12,888,955

Mr. Beré 136,009 182,675 49,443 1,085,841

Mr. Tehle 235,217 720,034 40,113 877,225

Mr. Buley 195,683 784,780 39,692 870,668

Ms. Guion 200,483 497,956 33,107 724,171

Ms. Lowe 127,733 396,380 30,693 672,946

(1) Represents the transfer for value of options held by the NEOs in connection with the Merger. All of the

value realized by Messrs. Beré and Tehle and by Mss. Guion and Lowe and $754,868 of the value realized

by Mr. Buley was rolled over into Rollover Options.

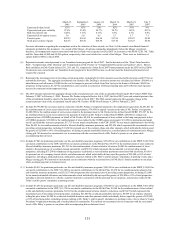

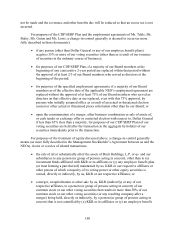

Pension Benefits

Fiscal 2007

We provided retirement benefits to Mr. Perdue under an unfunded, non-qualified defined

benefit pension plan, or SERP. As a result of the Merger, which constituted a change-in-control

under the terms of the SERP and the related grantor trust agreement, and Mr. Perdue’ s

resignation effective July 6, 2007, Mr. Perdue became 100% vested in his SERP account and the

actuarial equivalent of the lump sum value of Mr. Perdue’ s accrued benefit was funded to the

grantor trust. The material terms of Mr. Perdue’ s SERP are discussed following the table.

Name Plan Name

Number of Years

Credited Service

(#)

Present

Value of

Accumulated Benefit

($)

Payments During

Last Fiscal Year

($)(1)

Mr. Perdue

Supplemental Executive

Retirement Plan for

David A. Perdue

N/A

0

6,208,966

(1) On January 7, 2008, distribution was made to Mr. Perdue of the entire benefit obligation under the terms of his

SERP consisting of $6,028,122 of vested benefit and $180,844 in interest. The distribution to Mr. Perdue was

made six months following his termination date to comply with Section 409A of the Internal Revenue Code (the

“Code”).

Mr. Perdue’ s SERP provided for an annual normal retirement benefit equal to 25% of

“final average compensation” upon retirement on or after his “normal retirement date”, payable