Dollar General 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

related to financing the Merger of $87.4 million as of the Merger date are reflected in other long-

term assets in the consolidated balance sheet.

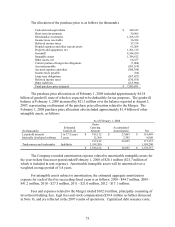

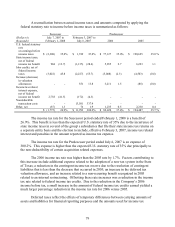

The following represents the unaudited pro forma results of our consolidated operations

as if the Merger had occurred on February 4, 2006, after giving effect to certain adjustments,

including the depreciation and amortization of the assets acquired based on their estimated fair

values and changes in interest expense resulting from changes in consolidated debt (in

thousands):

(In thousands)

Year Ended

February 1,

2008

Year ended

February 2,

2007

Revenue $ 9,495,246 $ 9,169,822

Net loss (57,939) (156,188)

The pro forma information does not purport to be indicative of what the Company’ s

results of operations would have been if the acquisition had in fact occurred at the beginning of

the periods presented, and is not intended to be a projection of the Company’ s future results of

operations.

Subsequent to the announcement of the Merger Agreement, the Company and its

directors, along with other parties, were named in seven putative class actions filed in Tennessee

state courts alleging claims for breach of fiduciary duty arising out of the proposed Merger, all as

described more fully under “Legal Proceedings” in Note 7 below.

3. Strategic initiatives

During 2006, the Company began implementing certain strategic initiatives related to its

historical inventory management and real estate strategies, as more fully described below.

Inventory management

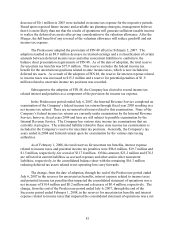

In November 2006, the Company undertook an initiative to discontinue its historical

inventory packaway model for virtually all merchandise by the end of fiscal 2007. Under the

packaway model, unsold inventory items were stored on-site and returned to the sales floor to be

sold year after year, until the items were eventually sold, damaged or discarded. Through end-of-

season and other markdowns, this initiative resulted in the elimination of seasonal, home

products and basic clothing packaway merchandise to allow for increased levels of newer,

current-season merchandise. In connection with this strategic change, in the third quarter of

2006 the Company recorded a reserve for lower of cost or market inventory impairment

estimates of $63.5 million and incurred higher markdowns and writedowns on inventory in the

second half of 2006 and in 2007 than in comparable prior-year periods. As a result of the

Merger and in accordance with SFAS 141, the Company’ s inventory balances, including the

inventory associated with this strategic change, were adjusted to fair value and the related

reserve was eliminated.