Dollar General 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

161

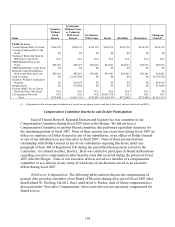

During fiscal 2007 but prior to the Merger, our Board of Directors consisted of David

Perdue, David Beré, Dennis Bottorff, Barbara Bowles, Reginald Dickson, Gordon Gee, Barbara

Knuckles, Neal Purcell, James Robbins, Richard Thornburgh and David Wilds. Also during that

time period, our Audit Committee consisted of Mr. Robbins, Mr. Bottorff, Ms. Bowles and Mr.

Purcell; our Compensation Committee consisted of Mr. Bottorff, Mr. Dickson and Mr. Gee; and

our Nominating and Corporate Governance Committee consisted of Mr. Wilds, Mr. Gee and Ms.

Knuckles. Our Board of Directors had affirmatively determined on March 20, 2007 that

Directors Bottorff, Bowles, Dickson, Gee, Knuckles, Purcell, Robbins, Thornburgh and Wilds,

but not Directors Perdue or Beré (each of whom was a member of management), were

independent from our management under both the NYSE’ s listing standards and our additional

categorical independence standards based on information known at that time. Any relationship

between an independent director and Dollar General or our management were either

encompassed by the Board-adopted categorical standards mentioned above or, in the case of Mr.

Wilds’ relationship with a vendor, deemed to be immaterial. A table setting forth the transactions

or relationships with our former directors that fell within a Board-adopted categorical standard,

as well as a description of Mr. Wilds’ relationships with a vendor, was set forth in our Form 10-

K for the fiscal year ended February 2, 2007. Because of the Merger, our Board has not made

any additional independence determinations with respect to those former Board members.

(c) Related Party Transactions. We describe below the transactions that have occurred

since the beginning of fiscal 2007, and any currently proposed transactions, that involve Dollar

General and exceed $120,000, and in which a related party had or has a direct or indirect

material interest.

(1) Relationships with Management:

Management Stockholder’s Agreement. Simultaneously with the closing of the Merger

and, thereafter, in connection with our offering equity awards to certain members of our

management and other employees (the “Management Participants”) under our stock incentive

plan (including the equity grants to Mr. Dreiling in connection with his offer of employment),

we, Parent and each of the Management Participants who held shares of our capital stock

(including through option exercises), or who were granted new options to acquire our stock (or,

in the case of Mr. Dreiling, who was granted shares of restricted common stock), entered into a

stockholder’ s agreement. The Management Stockholder’ s Agreement imposes significant

transfer restrictions on shares of our common stock. Generally, shares will be nontransferable by

any means at any time prior to July 6, 2012, except (i) sales pursuant to an effective registration

statement filed by us under the Securities Act in accordance with the Management Stockholder’ s

Agreement, (ii) a sale pursuant to the Sale Participation Agreement (described below), (iii) a sale

to certain permitted transferees, or (iv) as otherwise permitted by our Board of Directors or

pursuant to a waiver given by the Sponsor; provided, that, in the event the Sponsor or its

affiliates transfer limited partnership units owned by them to a third party, such transfer

restrictions shall lapse with respect to the same proportion of shares of common stock owned by

a management stockholder as the proportion of limited partnership units transferred by the

Sponsor and such affiliates relative to the aggregate number of limited partnership units owned

by them prior to that transfer.