Dollar General 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183

|

|

135

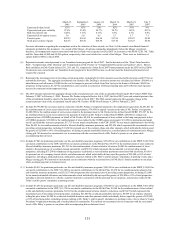

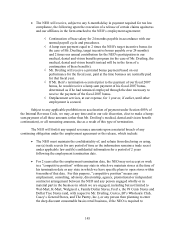

(6) Represents pre-Merger grants of time-vested, non-qualified stock options under the 1998 Stock Incentive Plan which became fully vested in

connection with the Merger. The per share exercise price equals the closing market price of our common stock on the grant date.

(7) Represents Rollover Options which are governed by the terms of the 1998 Stock Incentive Plan. The per share exercise price equals the

exercise price of the original surrendered option (which was the closing market price of our common stock on the grant date) as adjusted to

reflect our capitalization immediately following the Merger. As described in the narrative before this Grants of Plan-Based Awards Table,

the NEOs paid the following consideration for the Rollover Options: Mr. Beré, $182,675; Mr. Tehle, $720,034; Mr. Buley, $754,868; Ms.

Guion, $497,956; and Ms. Lowe, $396,380. Because we will not recognize any compensation expense in connection with the Rollover

Options on a going forward basis, we have not determined the grant date fair values of those options in accordance with SFAS 123R, but

rather have disclosed their intrinsic values (equal to the difference between the fair market value of the common stock and the per share

exercise price of the Rollover Options multiplied by the number of shares underlying such Rollover Options) which we believe would not

be materially different from the SFAS 123R grant date fair value.

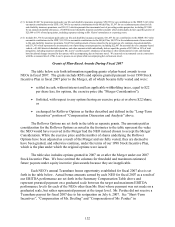

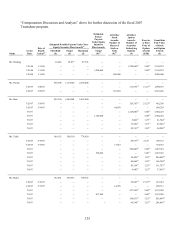

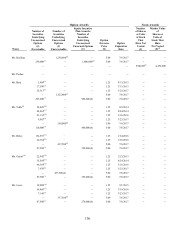

Outstanding Equity Awards at 2007 Fiscal Year-End

The table below sets forth information regarding outstanding equity awards held by our

NEOs as of the end of fiscal 2007.