Dollar General 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

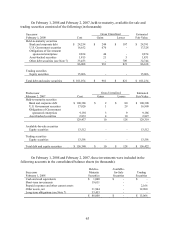

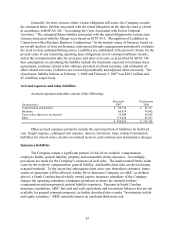

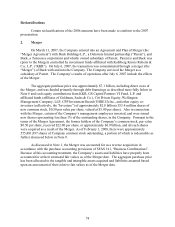

Predecessor

February 2, 2007

Held-to-

Maturity

Securities

Available-

for-Sale

Securities

Trading

Securities

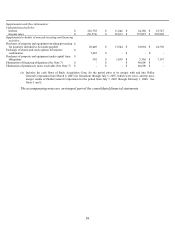

Cash and cash equivalents $ 79,764 $ 13,512 $ -

Short-term investments 29,950 - -

Prepaid expenses and other current assets - - 1,090

Other assets, net 19,723 - 12,501

$ 129,437 $ 13,512 $ 13,591

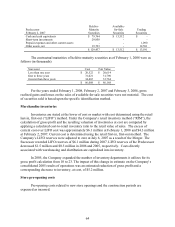

The contractual maturities of held-to-maturity securities as of February 1, 2008 were as

follows (in thousands):

Successor Cost Fair Value

Less than one year $ 20,522 $ 20,614

One to three years 31,021 31,790

Greater than three years 34,465 33,764

$ 86,008 $ 86,168

For the years ended February 1, 2008, February 2, 2007 and February 3, 2006, gross

realized gains and losses on the sales of available-for-sale securities were not material. The cost

of securities sold is based upon the specific identification method.

Merchandise inventories

Inventories are stated at the lower of cost or market with cost determined using the retail

last-in, first-out (“LIFO”) method. Under the Company’ s retail inventory method (“RIM”), the

calculation of gross profit and the resulting valuation of inventories at cost are computed by

applying a calculated cost-to-retail inventory ratio to the retail value of sales. The excess of

current cost over LIFO cost was approximately $6.1 million at February 1, 2008 and $4.3 million

at February 2, 2007. Current cost is determined using the retail first-in, first-out method. The

Company’ s LIFO reserves were adjusted to zero at July 6, 2007 as a result of the Merger. The

Successor recorded LIFO reserves of $6.1 million during 2007. LIFO reserves of the Predecessor

decreased $1.5 million and $0.5 million in 2006 and 2005, respectively. Costs directly

associated with warehousing and distribution are capitalized into inventory.

In 2005, the Company expanded the number of inventory departments it utilizes for its

gross profit calculation from 10 to 23. The impact of this change in estimate on the Company’ s

consolidated 2005 results of operations was an estimated reduction of gross profit and a

corresponding decrease to inventory, at cost, of $5.2 million.

Store pre-opening costs

Pre-opening costs related to new store openings and the construction periods are

expensed as incurred.