Dollar General 2007 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

interests. For example, the Investors could cause us to make acquisitions that increase the

amount of indebtedness that is secured or that is senior to our outstanding debt securities or to

sell assets, which may impair our ability to make payments under our outstanding debt securities.

Additionally, the Investors are in the business of making investments in companies and

may from time to time acquire and hold interests in businesses that compete directly or indirectly

with us. The Investors may also pursue acquisition opportunities that may be complementary to

our business and, as a result, those acquisition opportunities may not be available to us. So long

as the Investors, or other funds controlled by or associated with the Investors, continue to

indirectly own a significant amount of the outstanding shares of our common stock, even if such

amount is less than 50%, the Investors will continue to be able to strongly influence or

effectively control our decisions.

ITEM 2. PROPERTIES

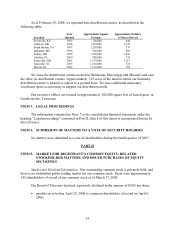

As of February 29, 2008, we operated 8,222 retail stores located in 35 states as follows:

State Number of Stores State Number of Stores

Alabama 446 Nebraska 80

Arizona 51 New Jersey 22

Arkansas 224 New Mexico 42

Colorado 19 New York 223

Delaware 24 North Carolina 467

Florida 415 Ohio 465

Georgia 464 Oklahoma 271

Illinois 306 Pennsylvania 393

Indiana 302 South Carolina 316

Iowa 170 South Dakota 12

Kansas 144 Tennessee 403

Kentucky 300 Texas 969

Louisiana 326 Utah 9

Maryland 57 Vermont 3

Michigan 238 Virginia 243

Minnesota 16 West Virginia 149

Mississippi 256 Wisconsin 88

Missouri 309

Most of our stores are located in leased premises. Individual store leases vary as to their

terms, rental provisions and expiration dates. The majority of our leases are relatively low-cost,

short-term leases (usually with initial or primary terms of three to five years) often with multiple

renewal options. We also have stores subject to build-to-suit arrangements with landlords, which

typically carry a primary lease term of between 7 and 10 years with multiple renewal options. In

recent years, an increasing percentage of our new stores have been subject to build-to-suit

arrangements. In 2007, approximately 70% of our new stores were build-to-suit arrangements.