Dollar General 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

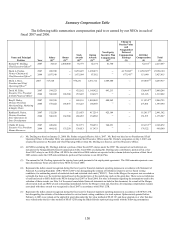

131

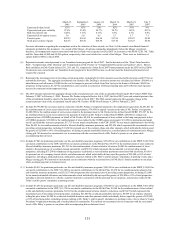

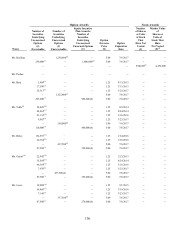

March 15,

2005

September 1,

2005

January 24,

2006

March 16,

2006

March 23,

2007

July 7,

2007

Expected dividend yield .85% .85% 1.0% .82% .91% 0%

Expected stock price volatility 27.4% 25.9% 24.7% 28.7% 18.5% 42.3%

Risk-free interest rate 4.25% 3.71% 4.31% 4.7% 4.5% 4.9%

Expected life of options (years) 5.0 5.0 4.5 5.7 5.7 7.5

Exercise price $22.35 $18.51 $16.94 $17.54 $21.25 $5.00

Stock price on date of grant $22.35 $18.51 $16.94 $17.54 $21.25 $5.00

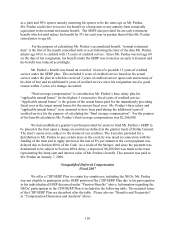

For more information regarding the assumptions used in the valuation of these awards, see Note 9 of the annual consolidated financial

statements included in this document. As a result of the Merger, all options outstanding immediately before the Merger vested and,

therefore, all compensation expense associated with those awards was recognized in fiscal 2007 in accordance with SFAS 123R. Mr. Tehle

and Ms. Guion had 63,000 and 50,300 options, respectively, that were forfeited as a result of the Merger. There were no forfeitures of

options held by NEOs in fiscal 2006.

(6) Represents amounts earned pursuant to our Teamshare bonus program for fiscal 2007. See the discussion of the “Short-Term Incentive

Plan”, “Compensation of Mr. Dreiling” and “Compensation of Mr. Perdue” in “Compensation Discussion and Analysis” above. Messrs.

Beré and Buley and Ms. Guion deferred 5%, 20% and 5%, respectively of their fiscal 2007 bonus payments under the CDP in fiscal 2008.

No amounts were earned under our Teamshare bonus program for fiscal 2006 because we did not meet the financial performance level

required for a payout.

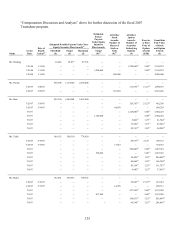

(7) Represents the incremental cost of providing certain perquisites, including $61,414 for amounts associated with relocation and $727 for an

automobile allowance. The aggregate incremental cost related to Mr. Dreiling’ s relocation amount was calculated as follows: $50,000 as a

miscellaneous cash allowance, $4,000 for the cost to transport a personal vehicle from New Jersey to his home in California, $4,803 for

temporary living expenses, $1,129 for transportation costs incurred in connection with house hunting trips and $1,482 for meal expenses

incurred in connection with temporary living.

(8) The 2007 amount represents the aggregate change in the actuarial present value of the accumulated benefit under Mr. Perdue's SERP from

February 2, 2007 to February 1, 2008. Because Mr. Perdue resigned effective July 6, 2007, the fiscal 2007 year-end actuarial present value

of the accumulated benefit is equal to the benefit paid to him in fiscal 2007. The 2006 amount represents the aggregate change in the

actuarial present value of the accumulated benefit under Mr. Perdue’ s SERP from February 4, 2006 to February 2, 2007.

(9) Includes $6,798,000 for severance paid in connection with Mr. Perdue’ s resignation pursuant to his employment agreement, $2,681,201 for

the reimbursement of excise taxes related to the severance payment, $78,438 for unused vacation at the time of Mr. Perdue’ s resignation,

$1,489,398 for the reimbursement of excise taxes related to the payment made to Mr. Perdue for his defined benefit SERP, $71,327 for the

tax reimbursement of excise taxes related to the payment of interest on Mr. Perdue’ s defined benefit SERP, $24,892 for a lump sum

payment in lieu of COBRA payments on behalf of Mr. Perdue, $9,818 for reimbursement of taxes related to the lump sum payment in lieu

of COBRA payments, $19,908 for the reimbursement of taxes related to the COBRA gross up payment, $11,249 for premiums paid under

our life and disability insurance programs, $17,753 for our match contributions to the CDP, $6,667 for our match contributions to the 401(k)

Plan, $6,452 for tax reimbursements related to life and disability insurance premiums, and $23,426 which represents the incremental cost of

providing certain perquisites, including $11,280 for personal use of the company plane and other amounts, which individually did not equal

the greater of $25,000 or 10% of total perquisites, including an annual automobile allowance, a medical physical examination and a Merger

closing gift. We incurred no incremental cost in connection with the occasional travel of Mr. Perdue’ s spouse on our plane while

accompanying him on travel.

(10) Includes $7,806 for premiums paid under our life and disability insurance programs, $53,683 for our contributions to the SERP, $32,872 for

our match contributions to the CDP, $2,854 for our match contributions to the 401(k) Plan, $4,477 for the reimbursement of taxes related to

life and disability insurance premiums, $21,336 for the reimbursement of taxes related to relocation, $4,906 for reimbursement of taxes

related to the personal use of a company-leased automobile, and $59,112 which represents the incremental cost of providing certain

perquisites, including $37,200 for temporary living expenses (calculated as rent and utility payments) associated with relocation, $18,601

for personal use of a company-leased vehicle, and other amounts which individually did not equal the greater of $25,000 or 10% of total

perquisites, including a medical physical examination, expenses related to Mr. Beré’ s and his spouse’ s attendance at sporting events, and a

Merger closing gift. We incurred no incremental cost in connection with the occasional travel of Mr. Beré’ s family members on our plane

while accompanying him on business travel.

(11) Includes $6,412 for premiums paid under our life and disability insurance programs, $58,618 for our contributions to the SERP, $18,403 for

our match contributions to the CDP, $11,198 for our match contributions to the 401(k) Plan, $3,678 for tax reimbursements related to life

and disability insurance premiums, and $32,155 which represents the incremental cost of providing certain perquisites, including $21,000

for an annual automobile allowance and other amounts which individually did not equal the greater of $25,000 or 10% of total perquisites,

including a directed donation to a charity, expenses incurred in connection with his personal use of our plane, and expenses related to Mr.

Tehle’ s and his guests’ attendance at sporting events.

(12) Includes $3,294 for premiums paid under our life and disability insurance programs, $34,868 for our contributions to the SERP, $18,148 for

our match contributions to the CDP, $11,174 for our match contributions to the 401(k) Plan, $1,890 for the reimbursement of taxes related

to life and disability insurance premiums, $2,182 for the reimbursement of taxes related to relocation, and $39,678 which represents the

incremental cost of providing certain perquisites, including $21,000 for an annual automobile allowance, $6,069 for an expense related to

selling his prior home, $5,000 for a directed charitable donation and other amounts which individually did not equal the greater of $25,000

or 10% of total perquisites, including expenses relating to Mr. Buley’ s and his guests’ attendance at sporting events, a fee to attend a Young

Presidents’ Organization meeting and a medical physical examination. We incurred no incremental cost in connection with the occasional

travel of Mr. Buley’ s spouse on our plane while accompanying him on business travel.