Dollar General 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.132

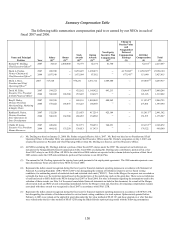

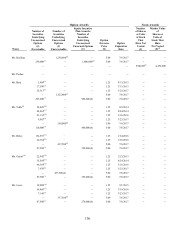

(13) Includes $9,447 for premiums paid under our life and disability insurance programs, $50,533 for our contributions to the SERP, $14,314 for

our match contributions to the CDP, $10,789 for our match contributions to the 401(k) Plan, $3,397 for tax reimbursements related to life

and disability insurance premiums, and $26,531 which represents the incremental cost of providing certain perquisites, including $21,000

for an annual automobile allowance, a $5,000 directed charitable donation and other amounts which individually did not equal the greater of

$25,000 or 10% of total perquisites, including expenses relating to Ms. Guion’ s attendance at a sporting event.

(14) Includes $11,754 for premiums paid under our life and disability insurance programs, $41,437 for our contributions to the SERP, $9,712 for

our match contributions to the CDP, $11,213 for our match contributions to the 401(k) Plan, $4,227 for the reimbursement of taxes related

to life and disability insurance premiums, $8,429 for reimbursement of taxes related to the personal use of a company-leased automobile,

and $31,361 which represents the incremental cost of providing certain perquisites, including $22,887 for personal use of a company-leased

vehicle, a $5,000 directed charitable donation, and other amounts which individually did not equal the greater of $25,000 or 10% of total

perquisites, including expenses relating to Ms. Lowe’ s and her guests’ attendance at sporting or other entertainment events and minimal

hotel incidental charges incurred by her spouse while accompanying her on business travel. We incurred no incremental cost in connection

with the occasional travel of Ms. Lowe’ s spouse on our plane while accompanying her on business travel.

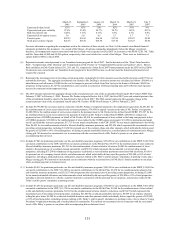

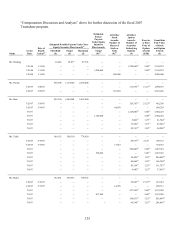

Grants of Plan-Based Awards During Fiscal 2007

The table below sets forth information regarding grants of plan-based awards to our

NEOs in fiscal 2007. The grants include RSUs and options granted pursuant to our 1998 Stock

Incentive Plan in fiscal 2007 prior to the Merger, all of which became fully vested and were:

• settled in cash, without interest and less applicable withholding taxes, equal to $22

per share less, for options, the exercise price (the “Merger Consideration”);

• forfeited, with respect to any options having an exercise price at or above $22/share;

or

• exchanged for Rollover Options as further described and defined in the “Long-Term

Incentives” portion of “Compensation Discussion and Analysis” above.

The Rollover Options are set forth in the table as separate grants. The amounts paid as

consideration for the Rollover Options as noted in the footnotes to the table represent the value

the NEO would have received in the Merger had the NEO instead chosen to accept the Merger

Consideration. While the exercise price and the number of shares underlying the Rollover

Options have been adjusted as a result of the Merger and are fully vested, they are deemed to

have been granted, and otherwise continue, under the terms of our 1998 Stock Incentive Plan,

which is the plan under which the original options were issued.

The table also includes options granted in 2007 on or after the Merger under our 2007

Stock Incentive Plan. We have omitted the columns for threshold and maximum estimated

future payouts under equity incentive plan awards because they are inapplicable.

Each NEO’ s annual Teamshare bonus opportunity established for fiscal 2007 also is set

forth in the table below. Actual bonus amounts earned by each NEO for fiscal 2007 as a result of

our EBITDA performance are set forth in the Summary Compensation Table above and

represent prorated payment on a graduated scale between the target and maximum EBITDA

performance levels for each of the NEOs other than Mr. Beré whose payment was not made on a

graduated scale, but rather represented payment at the target level. Mr. Perdue did not receive a

Teamshare payout for fiscal 2007 due to his resignation on July 6, 2007. See “Short-Term

Incentives”, “Compensation of Mr. Dreiling” and “Compensation of Mr. Perdue” in