Cablevision 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

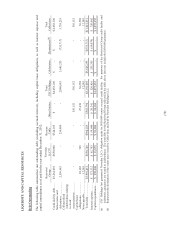

(89)

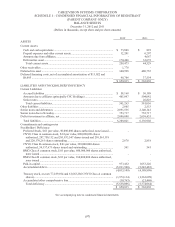

in respect of ongoing interest expense obligations and potential early termination events in connection with the

monetization of our holdings of shares of Comcast Corporation common stock. Does not include CSC Holdings'

guarantee of Newsday LLC's obligations under its $650,000 senior secured loan facility. Amounts due by period

for these arrangements represent the year in which the commitment expires.

(4) Consists primarily of letters of credit obtained by CSC Holdings in favor of insurance providers and certain

governmental authorities for the Telecommunications Services segment. Amounts due by period for these

arrangements represent the year in which the commitment expires.

(5) Includes interest payments and future payments due on our (i) credit facility debt, (ii) senior notes and debentures,

(iii) notes payable and (iv) collateralized indebtedness. See Notes 11 and 12 to our consolidated financial

statements for a discussion of our long-term debt.

(6) Reflects the principal amount of capital lease obligations, including related interest.

(7) This amount represents tax liabilities, including accrued interest, relating to uncertain tax positions.

At any time after the thirteenth anniversary of the closing of the Newsday Transaction and on or prior to

the date that is six months after such anniversary, Tribune Company will have the right to require CSC

Holdings to purchase Tribune Company's entire interest in Newsday Holdings LLC at the fair value of the

interest at that time. The table above does not include any future payments that would be required upon

the exercise of this put right.

Other Events

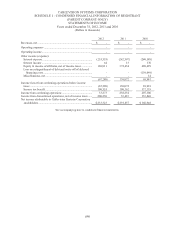

Common Stock Repurchase

In June 2010, Cablevision's Board of Directors authorized the repurchase of up to $500,000 of CNYG

Class A common stock. In February 2011, Cablevision's Board of Directors authorized the repurchase of

up to an additional $500,000 of CNYG Class A common stock. In May 2012, Cablevision's Board of

Directors authorized the repurchase of up to another $500,000 of CNYG Class A common stock giving us

the ability to repurchase up to a total of $1,500,000 of CNYG Class A common stock since inception of

the program. Under the repurchase program, shares of CNYG Class A common stock may be purchased

from time to time in the open market. Size and timing of these purchases will be determined based on

market conditions and other factors. Funding for the repurchase program will be met with cash on hand,

cash from operations, and/or borrowings under CSC Holdings' extended revolving loan facility, which

would be distributed to Cablevision.

For the year ended December 31, 2012, Cablevision repurchased an aggregate of 13,596,687 shares for a

total cost of $188,600, including commissions of $136. Since inception through December 31, 2012,

Cablevision repurchased an aggregate of 45,282,687 shares for a total cost of $1,044,678, including

commissions of $453. These acquired shares have been classified as treasury stock in Cablevision's

consolidated balance sheets. As of December 31, 2012, the Company had $455,322 of availability

remaining under its stock repurchase authorizations.

Dividends

Cablevision paid dividends aggregating $163,872 and $162,032 in 2012 and 2011, respectively, primarily

from the proceeds of equity distribution payments from CSC Holdings. In addition, as of December 31,

2012, up to approximately $5,684 will be paid when, and if, restrictions lapse on restricted shares

outstanding.