Cablevision 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(86)

guarantees of those obligations, will be secured by certain assets of the Bresnan Cable and the Guarantors,

including a pledge of the equity interests of Bresnan Cable.

Bresnan Cable may voluntarily prepay outstanding loans under the Bresnan Credit Agreement at any

time, in whole or in part, without premium or penalty (except for customary breakage costs with respect

to Eurodollar loans, if applicable). If Bresnan Cable makes a prepayment of term loans in connection

with certain refinancing transactions, Bresnan Cable must pay a prepayment premium of 1.00% of the

amount of term loans prepaid.

With certain exceptions, Bresnan Cable is required to make mandatory prepayments in certain

circumstances, including (i) a specified percentage of excess cash flow depending on its cash flow ratio,

(ii) from the net cash proceeds of certain sales of assets (subject to reinvestment rights), (iii) from casualty

insurance and/or condemnation proceeds, and (iv) upon the incurrence of certain indebtedness.

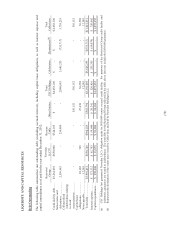

The term loan facility requires remaining quarterly repayments of $1,913 through September 2017, and a

final payment of approximately $713,363 upon maturity in December 2017. Any amounts outstanding

under the revolving loan facility are due at maturity in December 2015.

The Bresnan Credit Agreement contains customary affirmative and negative covenants and also requires

Bresnan Cable to comply with the following financial covenants: (i) a maximum ratio of total

indebtedness to operating cash flow (as defined) of 6.75:1 decreasing periodically to 5.00:1 on March 31,

2014; (ii) a minimum ratio of operating cash flow to interest expense of 2.25:1 increasing periodically to

2.75:1 on March 31, 2014, and (iii) minimum liquidity (as defined) of $25,000.

Bresnan Cable was in compliance with all of its financial covenants under its credit agreement as of

December 31, 2012.

Newsday LLC

We currently expect that net funding and investment requirements for Newsday LLC for the next

12 months will be met with one or more of the following: cash on hand, cash generated by operating

activities, interest income from the Cablevision senior notes held by Newsday Holdings LLC, capital

contributions and intercompany advances.

On October 12, 2012, Newsday LLC entered into a new senior secured credit agreement (the "New Credit

Agreement"), the proceeds of which were used to repay all amounts outstanding under its existing credit

agreement dated as of July 29, 2008. The New Credit Agreement consists of a $650,000 floating rate

term loan which matures on October 12, 2016. Interest under the New Credit Agreement is calculated, at

the election of Newsday LLC, at either the base rate or the eurodollar rate, plus 2.50% or 3.50%,

respectively, as specified in the New Credit Agreement. The New Credit Agreement requires semi-

annual repayments of $10,000 through June 2016, and a final payment of $580,000 upon maturity in

October 2016. Borrowings by Newsday LLC under the New Credit Agreement are guaranteed by CSC

Holdings on a senior unsecured basis and certain of its subsidiaries that own interests in Newsday LLC on

a senior secured basis. The New Credit Agreement is secured by a lien on the assets of Newsday LLC

and Cablevision senior notes with an aggregate principal amount of $753,717 owned by Newsday

Holdings.

The principal financial covenant for the New Credit Agreement is a minimum liquidity test of $25,000

which is tested bi-annually on June 30 and December 31. The New Credit Agreement also contains

customary affirmative and negative covenants, subject to certain exceptions, including limitations on

indebtedness, investments and restricted payments. Certain of the covenants applicable to CSC Holdings