Cablevision 2012 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-79

applied to subsequent assessments. The first half of the 2012 protest assessment of $4,607 was paid on

November 30, 2012; the second half is due May 31, 2013.

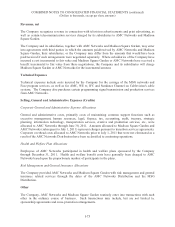

Other Legal Matters

On April 15, 2011, Thomas C. Dolan, a director and Executive Vice President, Strategy and

Development, in the Office of the Chairman at Cablevision, filed a lawsuit against Cablevision and

Rainbow Media Holdings in New York Supreme Court. The lawsuit raises compensation-related claims

(seeking approximately $11,000) related to events in 2005. The matter is being handled under the

direction of an independent committee of the Board of Directors of Cablevision. Based on the Company's

assessment of this possible loss contingency, no provision has been made for this matter in the

accompanying consolidated financial statements.

In addition to the matters discussed above, the Company is party to various lawsuits, some involving

claims for substantial damages. Although the outcome of these other matters cannot be predicted and the

impact of the final resolution of these other matters on the Company's results of operations in a particular

subsequent reporting period is not known, management does not believe that the resolution of these other

lawsuits will have a material adverse effect on the financial position of the Company or the ability of the

Company to meet its financial obligations as they become due.

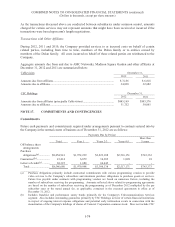

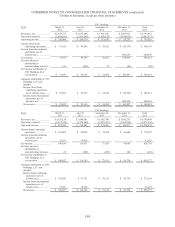

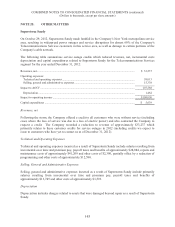

NOTE 18. SEGMENT INFORMATION

The Company classifies its operations into two reportable segments: (1) Telecommunications Services,

and (2) Other, consisting principally of (i) Newsday, (ii) Clearview Cinemas, (iii) the News 12 Networks,

(iv) the MSG Varsity network, (v) Cablevision Media Sales, and (vi) certain other businesses and

unallocated corporate costs.

The Company's reportable segments are strategic business units that are managed separately. The

Company evaluates segment performance based on several factors, of which the primary financial

measure is business segment adjusted operating cash flow ("AOCF") (defined as operating income (loss)

excluding depreciation and amortization (including impairments), share-based compensation expense or

benefit and restructuring expense or credit), a non-GAAP measure. The Company has presented the

components that reconcile adjusted operating cash flow to operating income (loss), an accepted GAAP

measure.