Cablevision 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-28

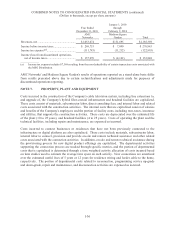

The Company reviews its long-lived assets (property, plant and equipment, and intangible assets subject

to amortization that arose from acquisitions) for impairment whenever events or circumstances indicate

that the carrying amount of an asset may not be recoverable. If the sum of the expected cash flows,

undiscounted and without interest, is less than the carrying amount of the asset, an impairment loss is

recognized as the amount by which the carrying amount of the asset exceeds its fair value.

Goodwill and Indefinite-Lived Intangible Assets

Goodwill and the value of franchises, trademarks, licenses and certain other intangibles acquired in

purchase business combinations which have indefinite useful lives are not amortized. Rather, such assets

are tested for impairment annually or upon the occurrence of a triggering event.

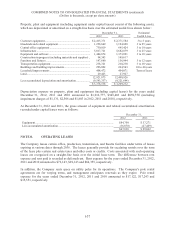

The following description of the Company's policy for assessing goodwill for possible impairment

reflects the adoption in 2011 of ASU No. 2010-28, Intangibles - Goodwill and Other (Topic 350): When

to Perform Step 2 of the Goodwill Impairment Test for Reporting Units with Zero or Negative Carrying

Amounts. Prior to 2011, the Company performed the quantitative two-step process further described

below.

The Company assesses qualitative factors for its reporting units that carry goodwill. If the qualitative

assessment results in a conclusion that it is more likely than not that the fair value of a reporting unit

exceeds the carrying value, then no further testing is performed for that reporting unit.

When the qualitative assessment is not used, or if the qualitative assessment is not conclusive and it is

necessary to calculate the fair value of a reporting unit, then the impairment analysis for goodwill is

performed at the reporting unit level using a two-step approach. The first step of the goodwill impairment

test is used to identify potential impairment by comparing the fair value of a reporting unit with its

carrying amount, including goodwill utilizing an enterprise-value based premise approach. If the carrying

amount of a reporting unit exceeds its fair value, the second step of the goodwill impairment test is

performed to measure the amount of goodwill impairment loss, if any. The second step of the goodwill

impairment test compares the implied fair value of the reporting unit's goodwill with the carrying amount

of that goodwill. If the carrying amount of the reporting unit's goodwill exceeds the implied fair value of

that goodwill, an impairment loss is recognized in an amount equal to that excess. The implied fair value

of goodwill is determined in the same manner as the amount of goodwill which would be recognized in a

business combination.

The impairment test for other intangible assets not subject to amortization consists of a comparison of the

fair value of the intangible asset with its carrying value. If the carrying value of the intangible asset

exceeds its fair value, an impairment loss is recognized in an amount equal to that excess.

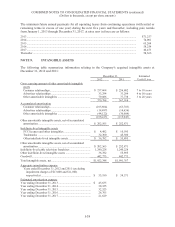

Deferred Financing Costs

Costs incurred to obtain debt are deferred and amortized to interest expense over the life of the related

debt.

Derivative Financial Instruments

The Company accounts for derivative financial instruments as either assets or liabilities measured at fair

value. The Company uses derivative instruments to manage its exposure to market risks from changes in

certain equity prices and interest rates and does not hold or issue derivative instruments for speculative or